These are two fundamental concepts in Forex trading that allow traders to control larger positions in the market with a smaller amount of capital.

While these tools can amplify profits, they also increase the level of risk, making it essential for traders to understand how they work.

1. What is leverage?

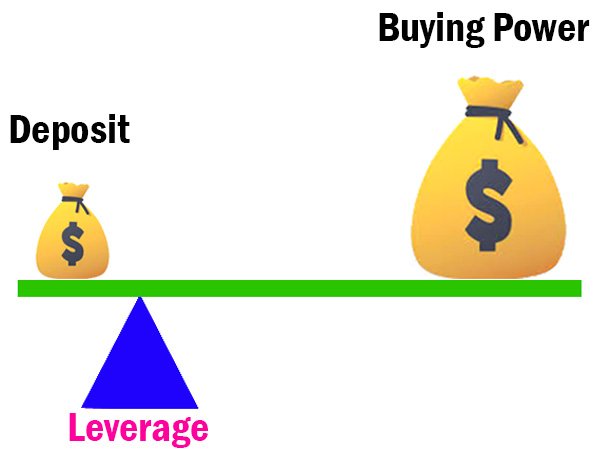

Leverage is a mechanism that allows traders to control a larger position than the amount of money they invest. In Forex, leverage is expressed as a ratio, such as 50:1, 100:1, or even higher. For instance, a leverage of 100:1 means that with $1,000 in your trading account, you can control a position size of $100,000.

Example:

If you have $1,000 in your account and use 100:1 leverage, you could trade up to $100,000. If the trade moves in your favor, your profits would be significantly higher than if you were trading without leverage. However, if the trade goes against you, losses can be equally large.

Advantages of Leverage:

- Increased Buying Power: Leverage allows traders to make larger trades and potentially higher returns with a smaller capital investment.

- Flexibility: Leverage enables traders to diversify their trading positions without needing a large account balance.

Risks of Leverage:

- Increased Risk of Loss: While leverage can magnify profits, it also amplifies losses. A small adverse movement in the currency price can result in a large loss, potentially exceeding your initial investment.

- Possibility of Margin Calls: If your trade moves too far in the wrong direction, your broker may issue a margin call, requiring you to deposit additional funds or risk having your position closed.

2. What is Margin?

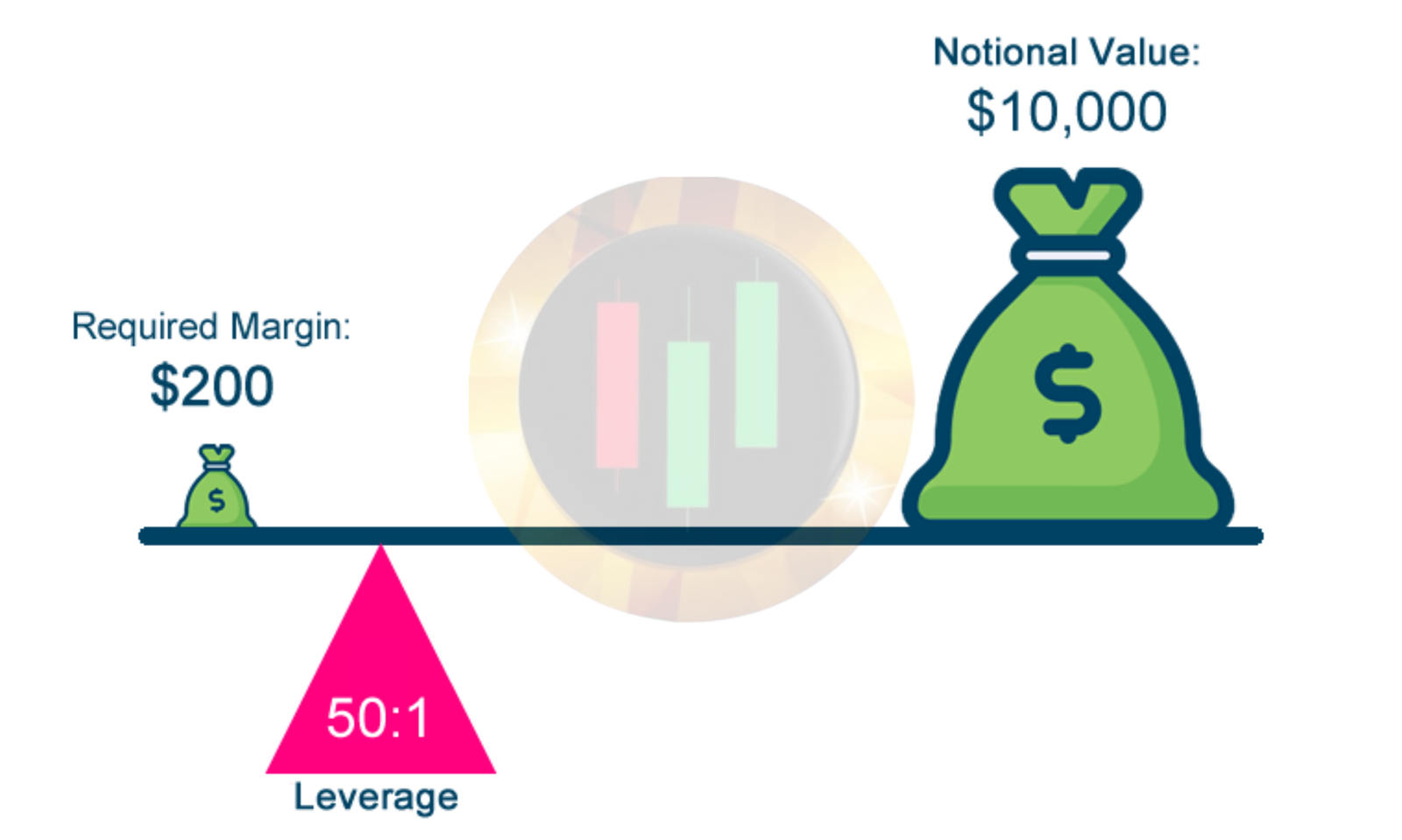

Margin is the amount of money a trader needs to open a leveraged position. It acts as collateral that brokers require to cover potential losses. Margin is not a fee or a cost, but a portion of your trading account balance set aside to open and maintain a position.

Example:

If a broker offers 100:1 leverage, and you wish to open a position worth $100,000, you would need $1,000 as margin (1% of the total trade size).

Types of Margin

- Initial Margin (Required Margin): This is the amount needed to open a position. It is calculated based on the leverage ratio.

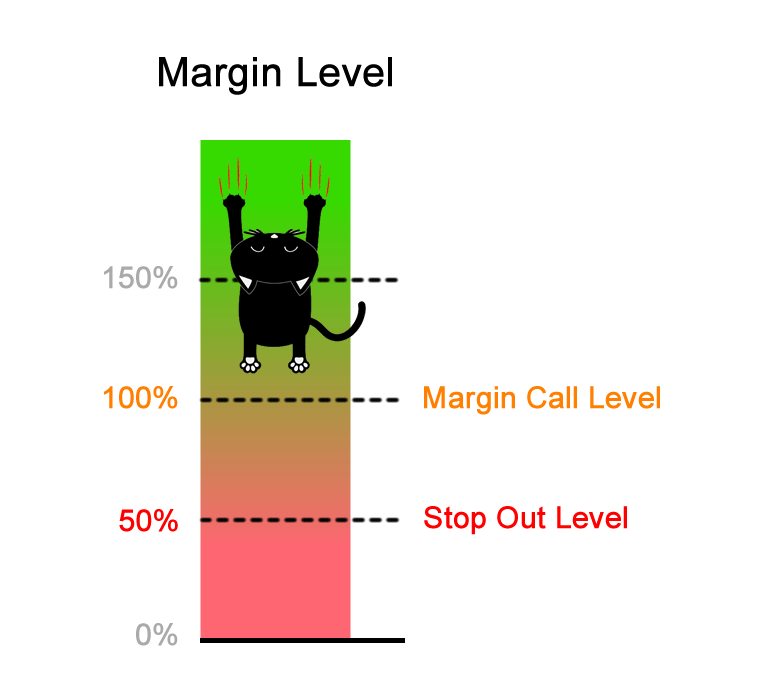

- Maintenance Margin: This is the minimum account balance required to keep a position open. If your balance falls below this threshold, the broker may issue a margin call.

3. Understanding Margin Call and Stop-Out Level

Margin Call: When the account balance falls below the required margin level, the broker will issue a margin call, requesting that the trader deposit additional funds to maintain the position. If the trader does not add funds, the broker may close the position to prevent further losses.Stop-Out Level: If the account balance continues to fall and reaches a certain level, known as the stop-out level, the broker may automatically close open positions to prevent the account from going negative.

4. Benefits and Risks of Leverage and Margin

Benefits:

- Enhanced Profit Potential: With leverage, traders can make a significant profit on relatively small price movements.

- Access to Larger Positions: Traders with limited capital can take on larger market positions.

Risks:

- Amplified Losses: Losses can exceed the initial investment, leading to substantial losses if not managed properly.

- Risk of Account Wipeout: High leverage increases the risk of wiping out your account balance if trades are not carefully managed.

Summary

Leverage and margin are powerful tools in Forex trading that allow for enhanced trading power with a smaller investment.

However, they come with considerable risk. To trade effectively, it’s crucial for traders to fully understand how leverage and margin work and to implement proper risk management strategies.

By doing so, traders can maximize their potential for profit while minimizing the risk of substantial loss.