For traders who have mastered the basics of Forex trading, it’s time to elevate your skills with advanced trading techniques. These strategies go beyond simple analysis and focus on using sophisticated tools and methods to fine-tune your trading approach, manage risks more effectively, and take advantage of complex market dynamics.

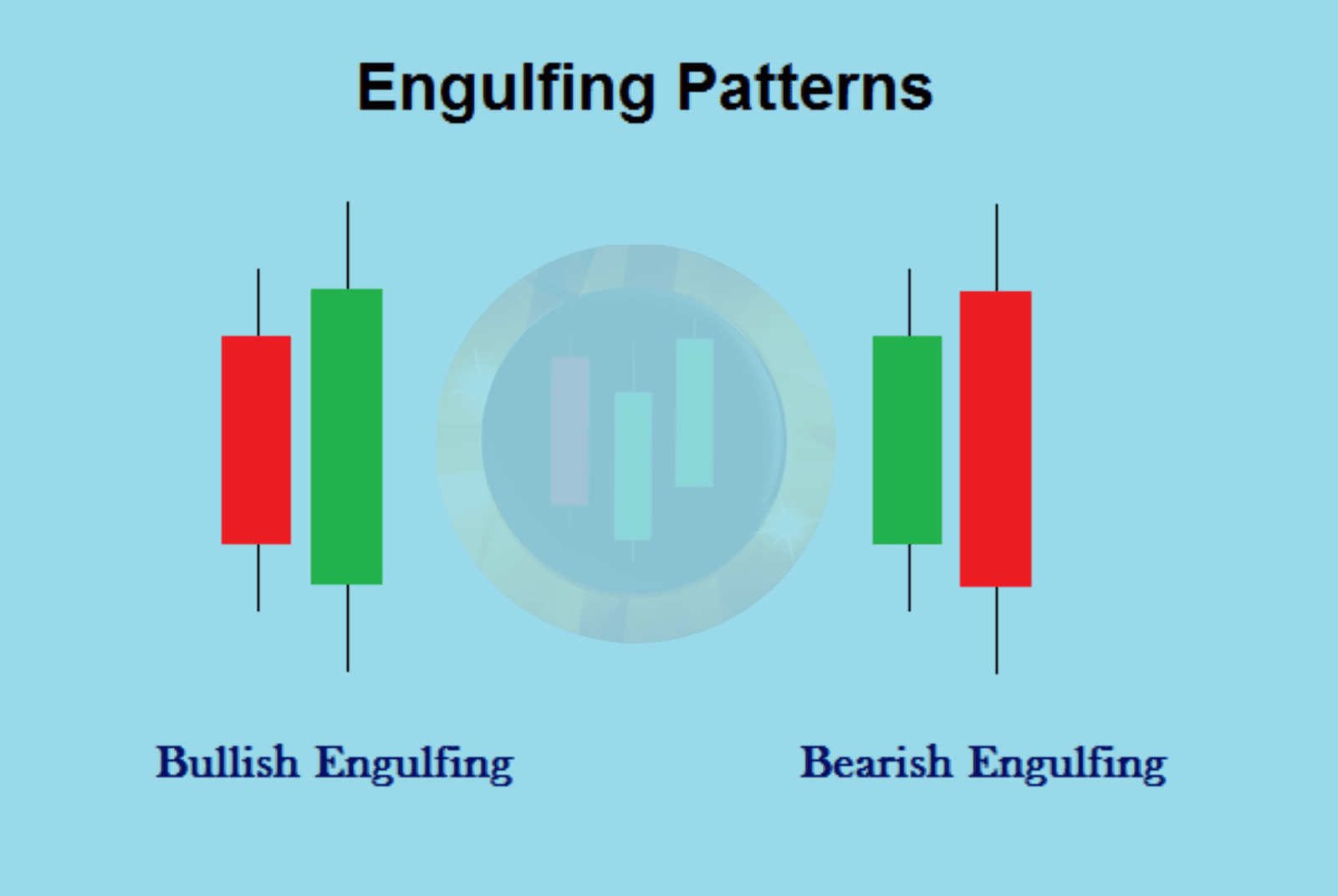

1. Advanced Chart Patterns

- Head and Shoulders: This classic reversal pattern signals a change in market direction. Learn how to spot head and shoulders and its inverse counterparts to catch major price moves.

- Double/Triple Top and Bottom: Recognizing these reversal patterns helps predict potential shifts in trend direction.

- Triangles (Symmetrical, Ascending, Descending): Triangular patterns often signal breakout opportunities. Master how to trade breakouts once price breaks out of these patterns.

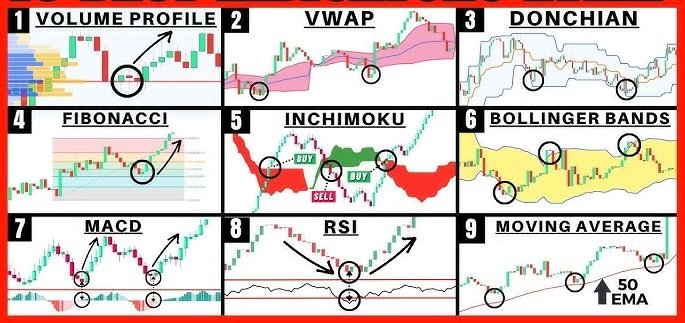

2. Technical Indicators for Experienced Traders

- Exponential Moving Averages (EMA) Crossovers: Using faster and slower EMAs, traders can identify potential market shifts and trends.

- Bollinger Bands: These help identify overbought or oversold market conditions and price volatility.

- MACD Divergence: Understanding how the MACD can signal momentum shifts and divergence from price can offer critical trade entry or exit points.

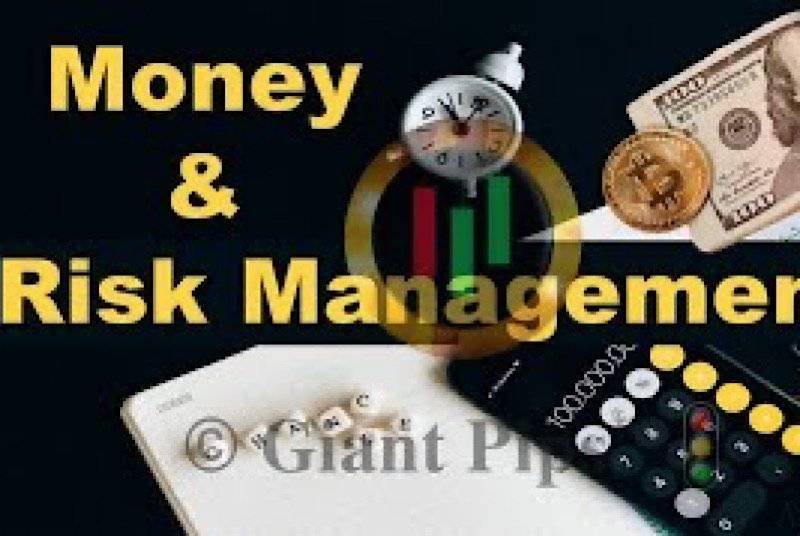

3. Risk Management Techniques

- Advanced Position Sizing: Using methods like the Kelly Criterion, you can calculate the optimal position size based on your risk tolerance and expected returns.

- Trailing Stops: Lock in profits as the market moves in your favor. A trailing stop moves with the market, helping to maximize profits while protecting against reversals.

- Volatility-Based Stop-Loss: Adjust your stop-loss orders based on the volatility of the market, allowing more room for price movement without risking large losses.

4. Algorithmic and Quantitative Trading

- Algorithmic Trading: Automating your trades based on pre-set conditions can help execute strategies quickly and without emotional bias.

- Backtesting: Before live trading, backtest strategies on historical data to determine their effectiveness and optimize them.

- Quantitative Trading: Use statistical models and algorithms to identify patterns and predict market behavior, giving you a data-driven edge.

5. Advanced Trading Strategies

- Carry Trade: Involves borrowing in low-interest rate currencies and investing in higher-yield currencies. Learn how to take advantage of interest rate differentials.

- Grid Trading: Set buy and sell orders at predefined intervals above and below a base price to capitalize on market fluctuations.

- Martingale Strategy: This involves doubling your position size after a losing trade in hopes of recovering the loss on the next win. Understand the risks involved.

- News Trading: Trade around major news releases and economic events. Develop a strategy that reacts quickly to market-moving news.

6. Psychology of Advanced Trading

- Emotional Control: Learn how to manage your emotions during volatile market conditions and avoid emotional decision-making that can lead to costly mistakes.

- Patience in Execution: Advanced traders wait for high-probability setups rather than chasing every price movement. Learn the importance of discipline and patience.

7. Trading Tools and Platforms for Pros

- Custom Indicators: Develop your own indicators to meet the specific needs of your trading strategy. These can help you spot trends, reversals, or other key market movements.

- Expert Advisors (EAs): Automate your trades using EAs. Program EAs to follow your strategy precisely and execute trades on your behalf.

- Advanced Charting Platforms: Master platforms like MetaTrader, TradingView, and others to take full advantage of their powerful analysis and trading features.

8. Market Analysis Beyond the Basics

- Order Flow Analysis: Understand how institutions and large traders move the market by analyzing their orders.

- Market Profile: Use volume analysis to identify key price levels and market activity.

- Intermarket Analysis: Analyze correlations between different markets (such as commodities, equities, and currencies) to predict Forex price movements.

9. Creating Your Advanced Trading Plan

- Refine Your Strategy: Take your knowledge and integrate advanced techniques into a comprehensive trading plan. Include risk management, psychological readiness, and backtesting for a well-rounded approach.

- Performance Tracking: Keep a detailed trading journal to monitor your trades, analyze your performance, and make necessary improvements.

By mastering advanced trading techniques, you can elevate your trading to new levels of success. These strategies, coupled with strong risk management and emotional control, will help you navigate the complexities of the Forex market with confidence and precision. Ready to take your trading to the next level? Start applying these advanced techniques today!