Market Insights

Understanding the dynamics of the Forex market is essential for making informed trading decisions. Our Market Insights section provides you with up-to-date analysis, expert opinions, and key trends that can influence currency prices. Whether you’re a beginner or an experienced trader, staying informed on the latest market developments is crucial for success.

1. Economic Indicators and Their Impact

- Inflation Rates: Inflation directly affects currency value. A rising inflation rate can signal the potential for interest rate hikes, impacting currency strength.

- Interest Rates: Central banks’ decisions on interest rates can drive significant movements in the Forex market. Higher rates typically attract more investors to a currency.

- Employment Reports: Employment data, such as non-farm payrolls (NFP) in the U.S., gives an indication of the health of an economy, influencing currency strength.

2. Global Events and Their Effects

- Geopolitical Tensions: Events like trade wars, elections, or international conflicts can create market uncertainty and drive volatility.

- Natural Disasters and Pandemics: Unexpected global events can cause drastic shifts in currency markets as traders react to risk-off sentiment.

- Government Policies: Changes in fiscal policies, regulations, or economic stimulus packages can affect market perception and currency behavior.

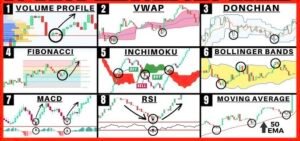

3. Technical Analysis for Market Insights

- Identifying Trends: We provide tools and resources for recognizing key market trends, so you can trade in the direction of the market momentum.

- Support and Resistance Levels: Learn how to identify critical price levels that may act as barriers for currency movements, helping you plan entry and exit points.

- Volume and Price Action: Analyze the relationship between volume and price to spot potential market reversals or breakouts.

4. Sentiment and Market Psychology

- Market Sentiment: Understanding whether the market is optimistic or fearful can give you an edge. Sentiment analysis helps determine the prevailing mood, whether risk-on or risk-off.

- Crowd Behavior: Often, the majority of traders will follow the same trend. Spotting when the crowd is overleveraged or overly confident can give you early warning signals for market corrections.

5. Expert Opinions and Analysis

- Stay up-to-date with insights from Forex professionals and analysts. Get expert commentary on major economic releases, central bank decisions, and global financial news. These insights can help you understand the broader market context and make more educated trading decisions.

6. Currency Pair Analysis

- We provide detailed analysis of major, minor, and exotic currency pairs, highlighting the factors that influence their movements. Learn how to track correlations and use this information to optimize your trading strategies.

7. Using Market Insights in Your Strategy

- Integrating market insights into your trading plan is essential for making strategic decisions. Whether you’re day trading or position trading, having the latest market news and analysis at your fingertips helps you anticipate price movements and act decisively.

Stay ahead of the curve by leveraging our Market Insights to make well-informed trading decisions. With access to expert analysis, timely updates, and key economic indicators, you’ll be equipped to navigate the ever-changing Forex market with confidence and precision.