What are candlesticks?

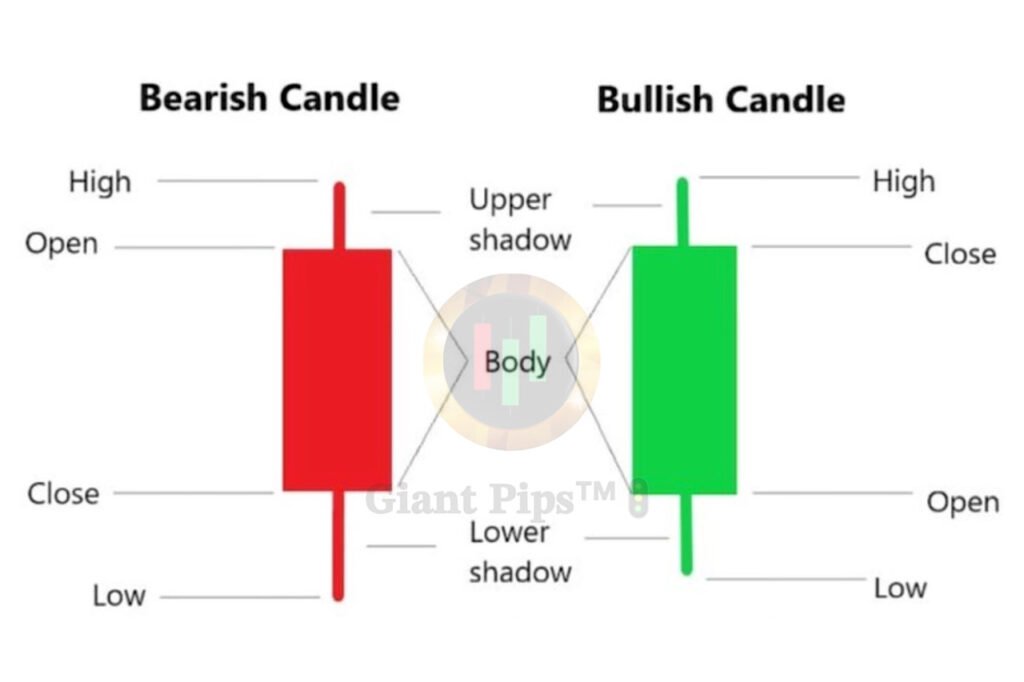

Candlesticks are formed using the open, high, low and close of the chosen time frame.

A candlestick is considered bullish if the close is above the open, indicating that the market is rising at this moment. Candlesticks are always used to show bullish candlesticks.

The majority of trading platforms designate bullish candlesticks with the green color. However, the color is irrelevant; you are free to use any color you like.

The open and close prices are the most crucial.

We might argue that the candlestick is bearish if the closing is below the open, indicating that the market is declining during this session.

Red candlesticks are always used to display bearish candles. This is not a rule, though.

To distinguish between bullish and bearish candlesticks, several colors are utilized.

The real body of the candlestick is the filled portion.

Shadows are the thin lines that protrude above and below the body.

The low is at the bottom of the lower shadow, while the high is at the top of the upper shade.

Discover Giant Hunter AI

Candlesticks body sizes:

Candlesticks have different body sizes:

Strong buying or selling pressure is referred to as long bodies.

If a candlestick shows a close that is above the open and has a long body, it means that buyers are more powerful and are controlling the market at this moment.

On the other hand, a bearish candlestick with a lengthy body and an open above the close indicates that selling pressure is in charge of the market during the selected time period.Small and short bodies suggest little activity in terms of buying or selling.

Candlestick shadows (tails)

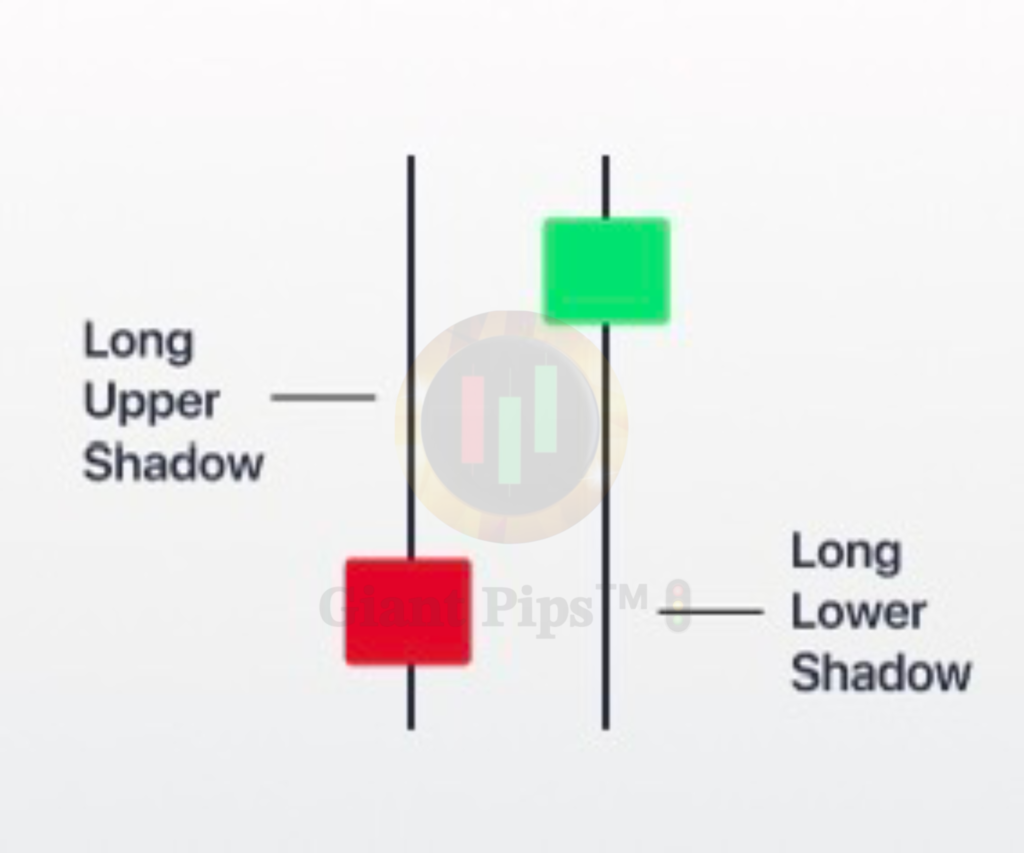

We can learn crucial details about the trading session from the upper and lower shadows.

The session high is indicated by upper shadows, and the session low is indicated by lower shadows.

Long-shadowed candlesticks indicate that trade activity took place far after the open and closing.

The majority of trading activity was concentrated close to the open and close, according to candlesticks with brief shadows.

A longer upper shadow and a shorter lower shadow on a candlestick indicate that buyers were assertive and raised their bid.

However, sellers entered the market and forced the price back down for a variety of reasons, bringing the session to a close to its opening price.

A candlestick with a large lower shadow and a short upper shadow indicates that sellers forced the price down by showing off their washboard abs.

However, for whatever reason, a buyer entered the market and caused prices to rise again, closing the session close to its opening price.