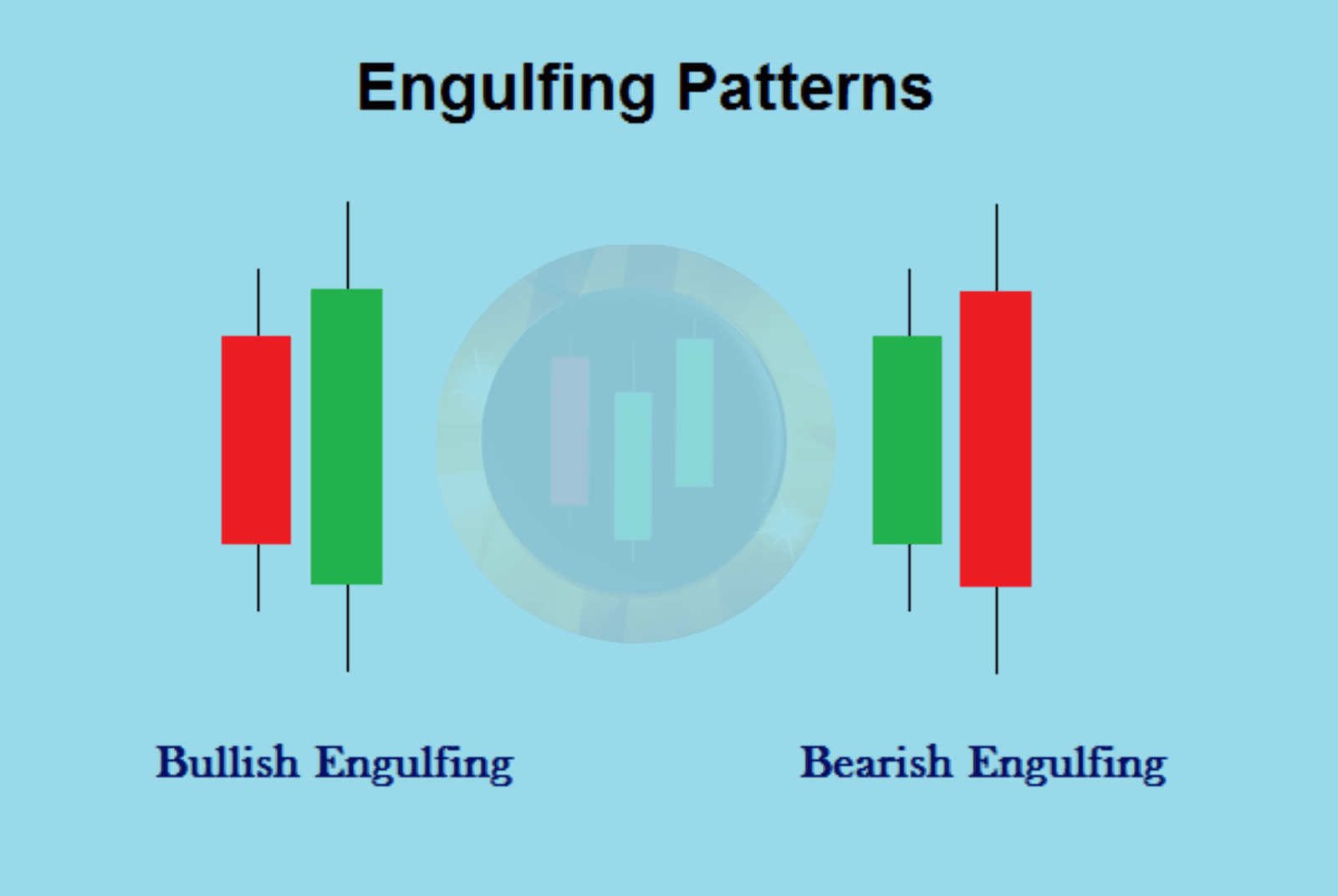

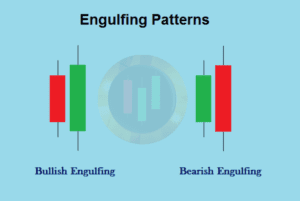

Money management is now our main point of focus since you’ve learned how to identify high-probability setups in the market from our previous lessons. However, not every engulfing bar pattern is worth trading.

You should avoid price action signals that have low risk/reward ratios. When you’ve found a high-probability setup that meets your criteria, there’s no need for further analysis—just ensure the trade has a potential risk-to-reward ratio of at least 2:1.

This means the amount you could win should be at least twice the amount you’re risking. See the example below:

The market was ranging, as you can see, and as we previously explained, the best price levels in sideways markets are the key supply and demand zones. All the necessary conditions were present to accept a buying order.

Discover Giant Hunter AI

An engulfing bar that forms in the demand area is a strong trading opportunity, but you must consider the risk and reward to ensure that the trade complies with your money management guidelines.

This trade has a 3:1 risk-to-reward ratio, which raises your odds of winning over the long run because you stand a better chance of making $600 if you risk $200. Prior to making any trades, it is crucial to determine your risk-to-reward ratio.

YouTube Must Watch Video

An analysis of a case

Let us say you make ten trades with a 3:1 risk/reward ratio. If you win, you will make 600 dollars, and if the market moves against you, you will lose $200.

Suppose you only won three transactions and lost seven. To find out if you won or lost, let us perform the math.

Three winning trades will earn you $1800, but seven bad deals will cost you $1400.

As you can see, you are still profitable even though you lost seven trades. This is how money management works.

The technique for entering and leaving

Keep it simple, do not try to outsmart other traders, and know what you are looking for when you spot an engulfing bar pattern and believe everything is set up for a successful trade.

Order as soon as the price action signal appears, place your stop loss below the candlestick pattern, and use the chart to determine the next level of support or resistance—this will be your profit goal.

View the following illustration:

Never look back once you have set your target and protective stop; instead, let the market tell you if you are correct or incorrect. This will enable you to trade effectively while controlling your emotions.

No one wants to lose, especially when it involves money, so in the trading environment you have to think differently and accept that losing is a part of the game.

If the market moves against you, you will not feel good; that is normal. Losing money can be emotionally painful; it is human nature.

According to studies, profitable traders never risk more than 2% of their equity on a single transaction.

Do not take on more than 1% risk if you are just starting off. Even though the engulfing bar pattern you recognize suggests a high probability signal, do not risk money you cannot afford on a single trade.