A Forex broker is a financial service provider that facilitates the buying and selling of currencies in the foreign exchange (Forex) market. They act as intermediaries, giving traders access to trading platforms where they can speculate on currency price movements. Forex brokers earn through spreads, commissions, or both.

Choosing a reliable Forex broker is one of the most critical steps for any trader looking to succeed in the financial markets.

At Giant Pips Forex Academy, our mission is to empower traders by providing the knowledge and insights needed to make informed decisions. In this post, we’ll guide you through the essential factors to consider when selecting a Forex broker, so you can trade with confidence.

Discover Giant Hunter AI

1. Regulation and Security

Your broker should be regulated by a reputable financial authority, which ensures they meet specific standards for fairness and transparency. Regulation is key to protecting your funds and personal information. Some trustworthy regulatory bodies include:

- NFA (National Futures Association) and CFTC (Commodity Futures Trading Commission) in the U.S.

- FCA (Financial Conduct Authority) in the U.K.

- ASIC (Australian Securities and Investments Commission) in Australia.

A regulated broker gives you the peace of mind that they are accountable and operate within a structured legal framework.

2. Trading Costs and Fees

Forex trading involves fees like spreads, commissions, and swap rates (if you hold positions overnight). These costs can vary significantly between brokers and impact your profitability. Before choosing a broker:

- Compare the spreads and commission rates on different currency pairs.

- Look out for hidden fees such as account maintenance fees, withdrawal fees, and inactivity charges.

- Consider your trading style – day traders might prioritize low spreads, while long-term traders may be more interested in lower swap rates.

3. Trading Platform and Tools

The broker’s trading platform is where you’ll conduct most of your activity, so it needs to be user-friendly, reliable, and equipped with the tools you need. Look for:

- A platform that offers efficient trade execution and doesn’t crash during high volatility.

- Essential charting tools, indicators, and analysis features.

- Mobile and desktop compatibility for trading on the go.

MetaTrader 4 and 5 are popular among Forex traders, but many brokers offer custom platforms. Test the demo version to ensure the platform suits your needs.

4. Customer Support

When trading in fast-moving markets, having responsive customer support is invaluable. Ideally, your broker should offer:

- 24/7 support via multiple channels (phone, email, live chat).

- Knowledgeable support agents who understand Forex trading.

- Assistance in multiple languages, if you’re more comfortable with a language other than English.

Read reviews to gauge the broker’s responsiveness and reliability in handling client queries and issues.

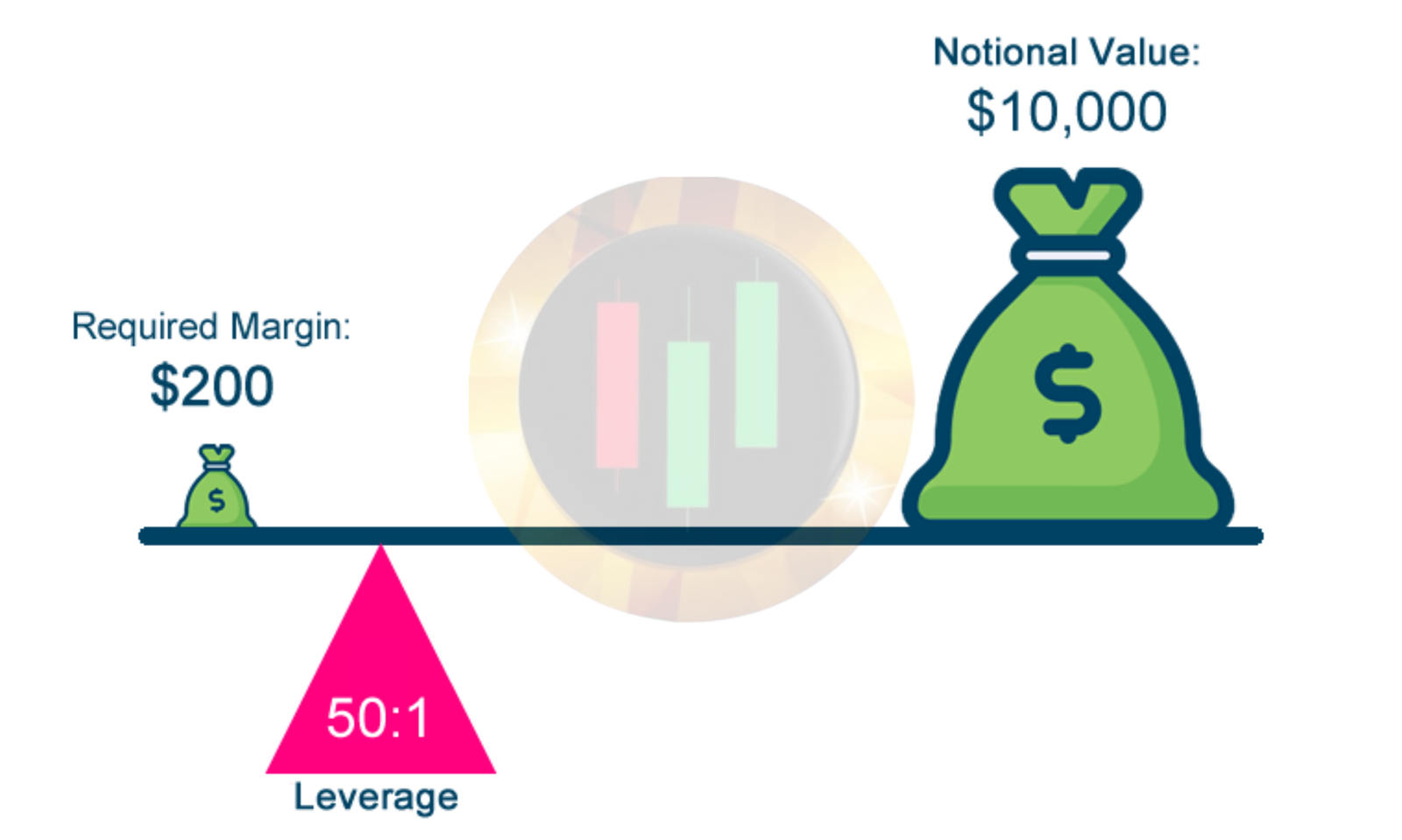

5. Account Types and Leverage Options

Brokers often offer various account types to cater to traders with different experience levels, budgets, and trading styles. When evaluating account options, consider:

- Minimum deposit requirements – Choose an account that aligns with your budget.

- Leverage and margin – Understand the broker’s leverage offerings, as this will impact your risk level. Be cautious with high leverage; while it can amplify profits, it can also increase losses.

- Account features – Some brokers offer Islamic (swap-free) accounts, cent accounts, or demo accounts, which may be beneficial depending on your needs.

6. Educational Resources

For beginners, choosing a broker that provides quality educational resources is a huge advantage. Many brokers offer:

- Free courses, webinars, and tutorials.

- Market analysis, trading signals, and daily reports.

- Interactive tools like economic calendars and risk management calculators.

A broker invested in educating its clients is often a good sign of transparency and commitment to long-term relationships.

7. Payment Methods and Withdrawal Policies

A good broker should offer secure, hassle-free deposit and withdrawal methods. Make sure to:

- Check if they support your preferred payment method, such as bank transfers, credit cards, PayPal, or cryptocurrency.

- Understand the withdrawal process and any potential delays or fees.

- Read reviews to ensure the broker processes withdrawals smoothly and without unnecessary obstacles.

Final Thoughts

Choosing a good Forex broker involves careful consideration and thorough research. At Giant Pips Forex Academy, we recommend using a checklist to evaluate each broker on the criteria above. Your broker should ultimately be one that aligns with your goals, provides solid support, and maintains a high standard of security and transparency. Remember, a good broker can be the foundation for successful trading, while a bad one can lead to complications that could otherwise be avoided.

Happy trading, and as always, keep learning with Giant Pips Forex Academy!