Profitable trading in Forex refers to consistently making more money from currency trades than you lose. It involves analyzing the market, managing risks, and executing trades based on informed strategies, not emotions.

You’ve come a long way, and now it’s time to get to the finish line.

Things you’ll do in this blog

1. Learn the main goal of trading.

2. Summarize the course materials.

3. Acknowledge your improvements.

4. Earn a certificate of completion.

Let’s take this last step together and get you on your way to becoming a competent and disciplined trader.

Discover Giant Hunter AI

The main goal of trading

After mastering risk management tools, you can confidently focus on trading’s primary goal—growing and stabilizing profits.

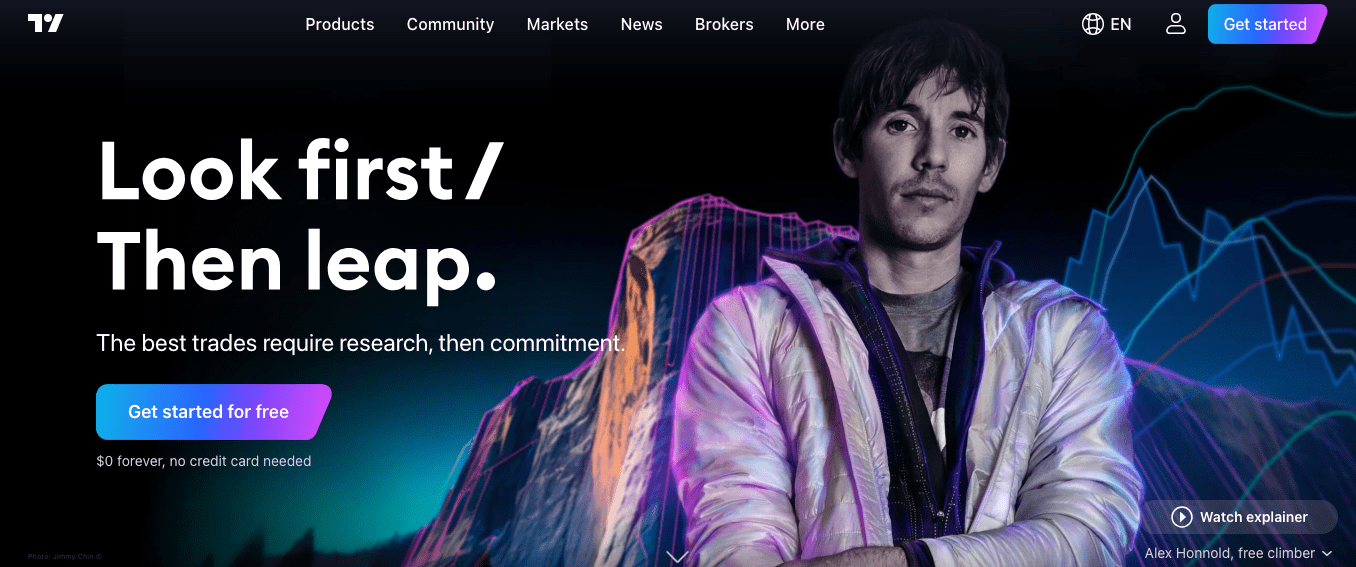

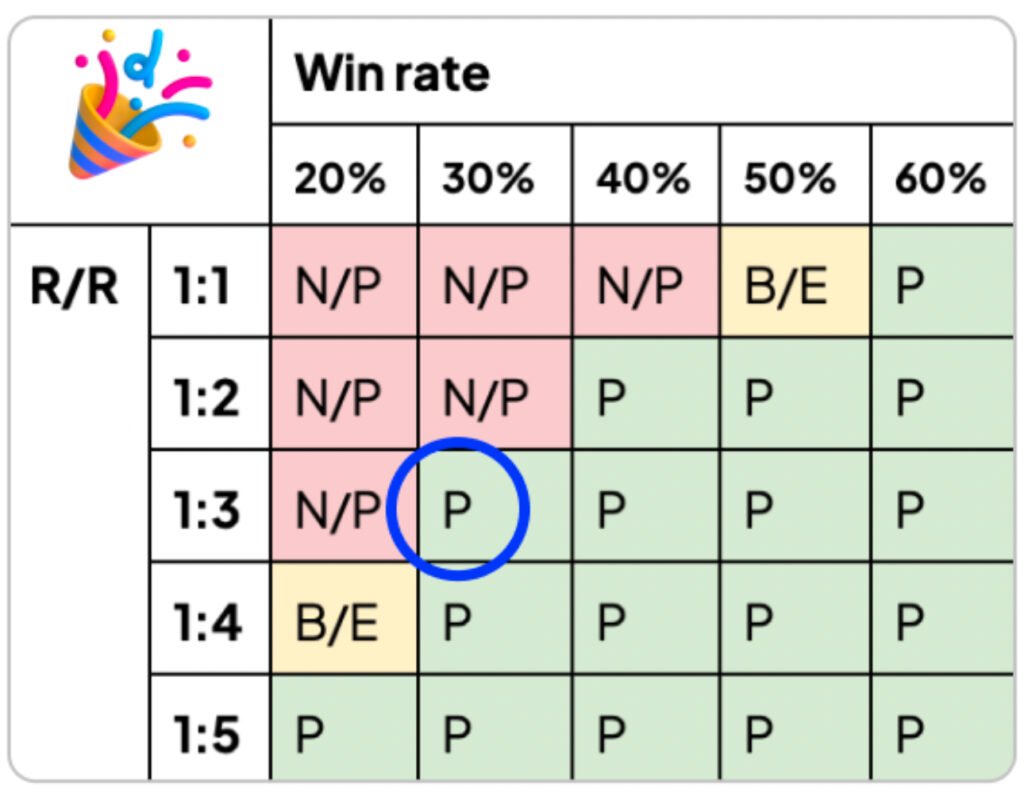

Two factors influence the profit: win rate and the risk/reward ratio (R/R). These two parameters determine whether your trading activity is profitable (P), breakeven (B/E), or not profitable (N/P).

The table below explains how you can grow or stabilize your income.

Conversely, a high value of one parameter doesn’t guarantee profitability if the other is outside the green zone.

Let’s find out how to use the profitability table step by step.

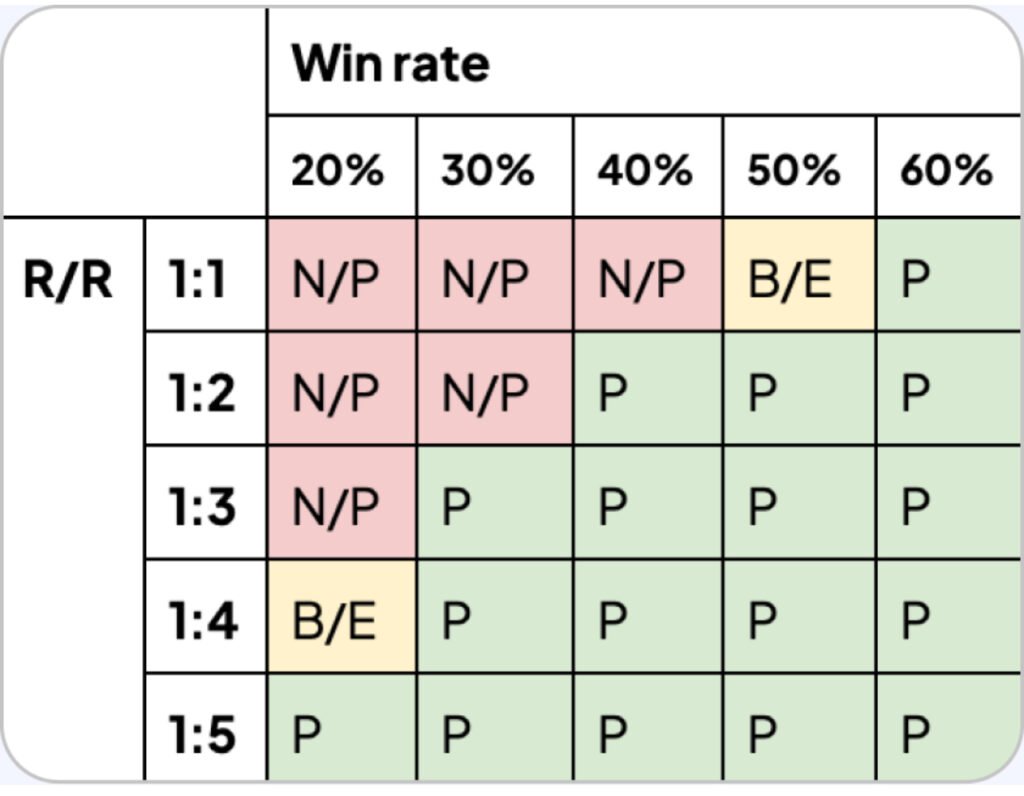

Step 1. Identify your current position

Determine your current win rate and risk/reward ratio. Match the corresponding cells in the table to see if your position is potentially profitable.

Step 2. Evaluate your strategy based on the cell value.

If the cell is marked ‘P’ (profitable)

1. Your strategy is effective.

2. Continue with your current approach.

3. Proceed to Step 4.

If the cell is marked ‘B/E’ (breakeven)

1. Your strategy is neutral.

2. Make a few adjustments to it.

3. Proceed to Step 3.

If the cell is marked ‘N/P’ (not profitable)

1. Your strategy is ineffective.

2. Revise it and make significant changes.

3. Proceed to Step 3.

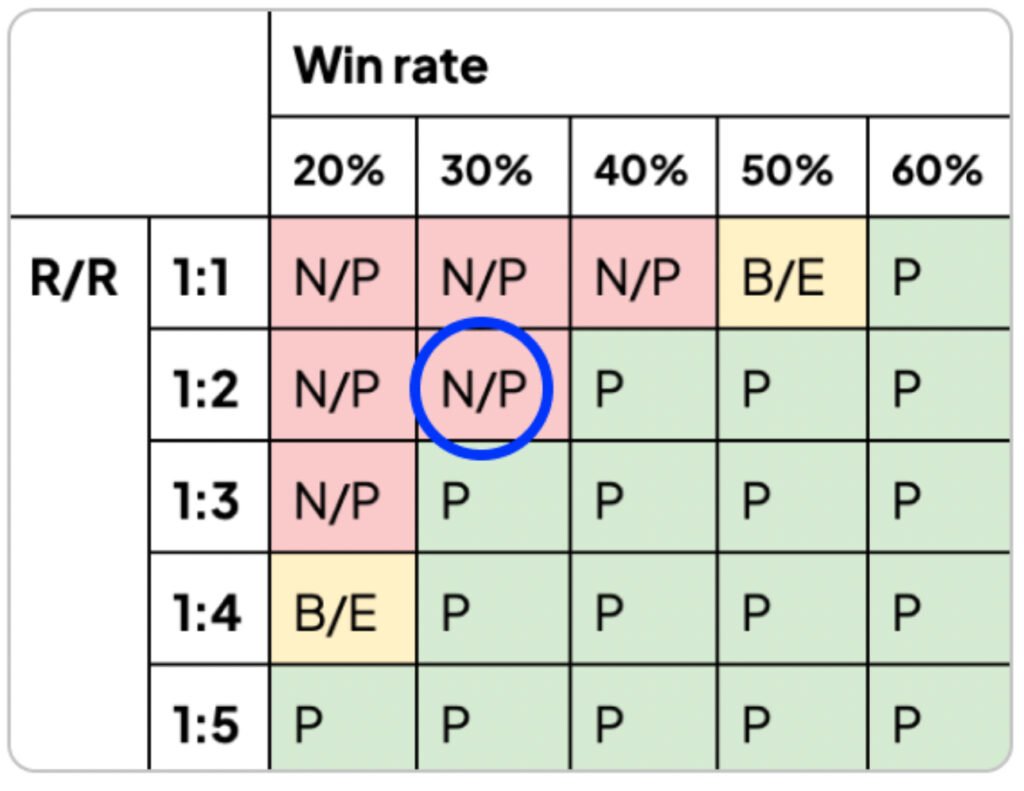

Step 3. Increase your win rate or adjust your risk/reward ratio.

Aim to move your position to a more favorable cell—from ‘N/P’ or ‘B/E’ to ‘P.’.

Step 4. Implement your revised strategy

Update your strategy and follow it for a whole week (or longer, if you want). Keep a detailed record of your trades to track your progress.

By following this algorithm, you can regularly upgrade your strategies, increasing your profitability over time.

Summary

Together with Mr. Riskman, we’ve gone through 5 lessons packed with valuable tips to help you become a more disciplined and successful trader.

Risks in trading

The first step on your journey was accepting that losses and risks are inevitable. You learned that managing risks is crucial for profitability.

Keep a trading journal to analyze your trades, identify patterns, and pinpoint areas for improvement.

It’s crucial for effective risk management.

Emotions and psychology

Next, you learned how to handle emotions while trading. You discovered that recognizing and accepting emotional decisions can help you follow your strategy better.

Set the take-profit and the stop-loss levels.

according to your strategy.

Use them as protection during market turbulence and difficult emotional situations.

Risk tolerance

Then, you explored various trading styles and risk tolerance levels. You studied the advantages and disadvantages of each type and realized their importance.

Start with a conservative approach and 1-2% risk per trade. Gradually increase your risk level as you gain confidence in your strategy.

Net profit and risk/reward ratio

Finally, you focused on mastering the risk/reward ratio, learning how it affects your net profit, and how to use it to your advantage.

Divide your stop-loss distance by your take-profit distance to calculate your risk/reward ratio.

• Try different ratios to find the one that maximizes your net profit.