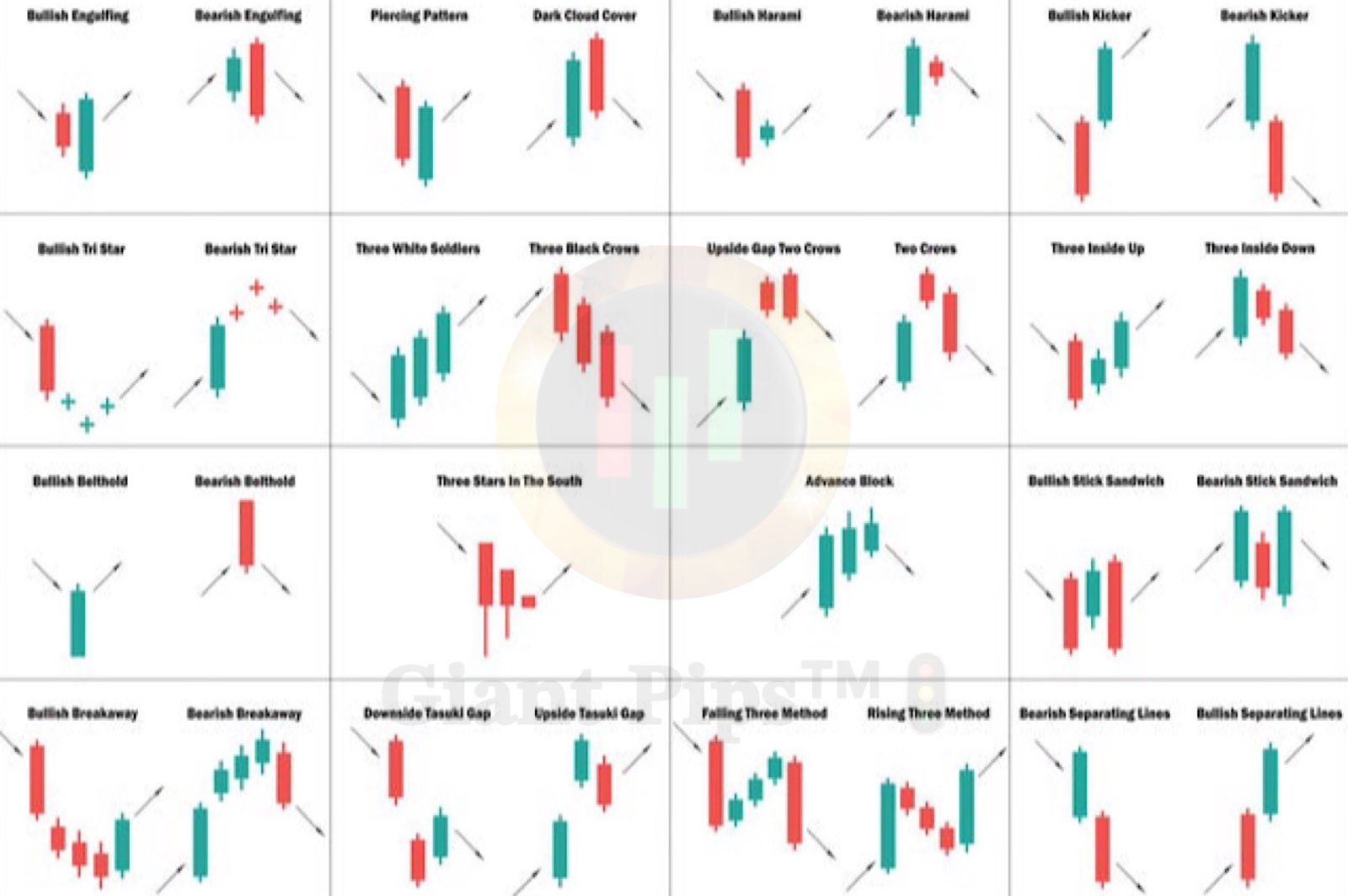

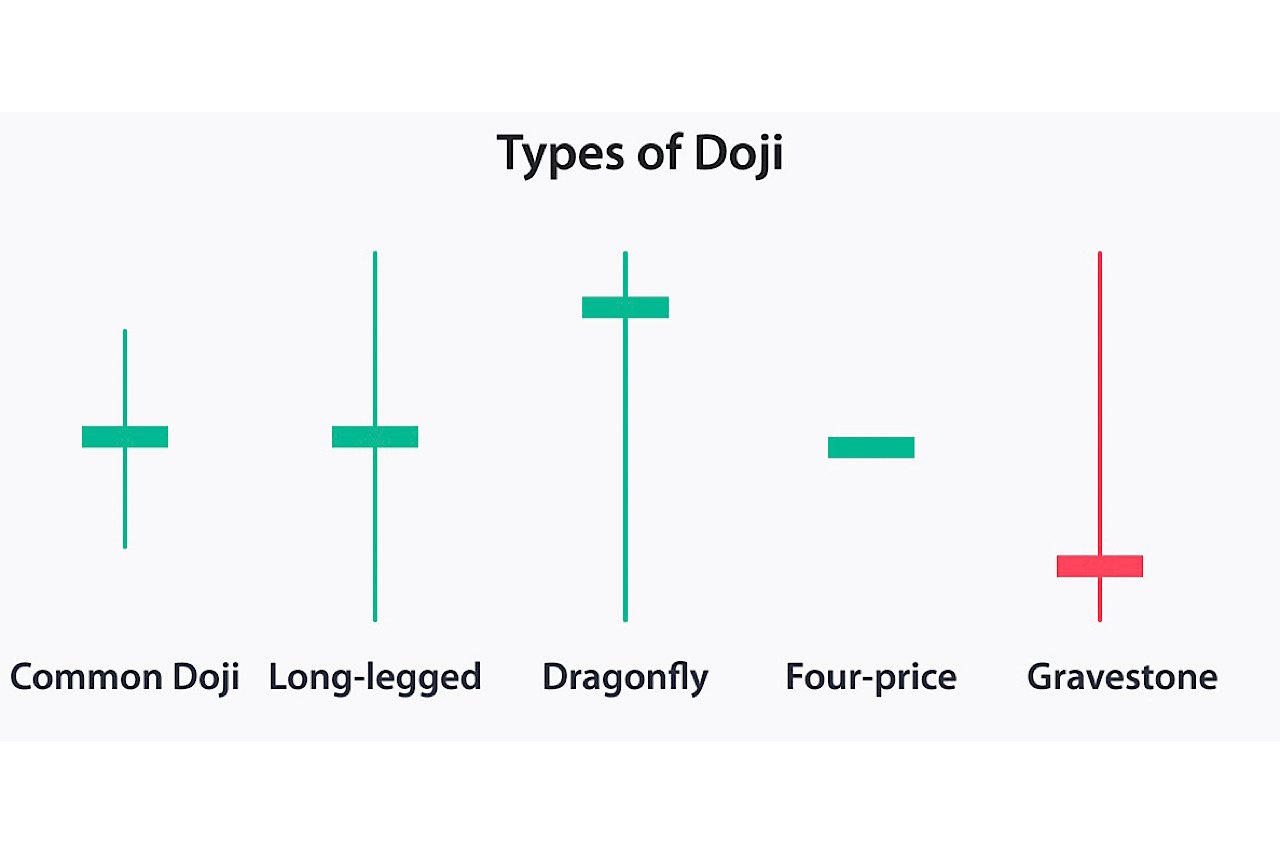

Candlestick patterns are among the most powerful tools in trading. They’re easy to spot, simple to understand, and can provide strong trading opportunities.

Studies show that they are highly predictive, often leading to successful trades. With over 20 years of experience using candlestick patterns myself, I can attest to their effectiveness. Despite trying countless other strategies, I always come back to them because they consistently deliver.

Discover Giant Hunter AI

That said, no trading method is foolproof. Losses are a natural part of trading. If you’re looking for a 100% success rate, this may not be the right path for you.

Think of candlestick patterns as the market’s language. Just like living in a foreign country requires you to understand the local language, trading successfully requires you to read market patterns. By learning to read candlestick patterns accurately, you’ll gain insight into market behavior and trader psychology. This skill helps you make better decisions on when to enter or exit trades, allowing you to follow in the footsteps of seasoned traders.

In this section, we’ll explore the most essential candlestick patterns you’ll encounter in the market. This is just the foundation—detailed trading techniques will be covered in the following chapters. For now, focus on understanding the structure of each pattern and the psychology behind it. With this knowledge, you’ll be well-prepared to master the strategies and tactics in the upcoming sections.