Forex pivot points are technical analysis indicators used by traders to determine potential support and resistance levels in the market.

They are calculated based on the previous trading session’s high, low, and closing prices. Pivot points are widely used in Forex trading because they are simple to calculate and can provide reliable entry and exit points for trades.

Support and resistance lines offer significant benefits while trading, and every trader should have them in their toolbox. Using a formula based on yesterday’s high, low, and close bars, multiple horizontal support and resistance lines can be effectively produced.

Discover the definition of Forex pivot points, a trading method that is frequently employed by expert traders, as well as how to trade them successfully, in this comprehensive article.

The pivot and three levels of support and resistance make up the formula’s pivot point levels, which can be traded utilizing a combination of breakout and bounce trading tactics in a manner similar to trading from ordinary support and resistance levels and trendlines.

Discover Giant Hunter AI

Since so many traders use the same levels based on the same calculation, the main benefit of this pivot point strategy is that it is “objective.” Discretion is not involved.

However, despite efforts by DeMark and others to make them more objective, the process of creating trendlines and support and resistance levels can be more impressionist and subjective (every trader can detect and draw different lines).

A second related advantage of using them is that because so many people are looking at these levels, they become self-fulfilling. The reason pivot points are so popular is that they are predictive as opposed to lagging. You use the information of the previous day to calculate reversal points (or breakout levels) for the present trading day.

Because so many traders (including the large institutional traders) follow pivot points, the market reacts at these levels, giving you an opportunity to trade them. Just like we have seen with price action support and resistance levels, traders can choose to trade the bounce or the break of these levels.

How are these levels determined?

Here is the magic formula:

| Resistance 3 = High + 2*(Pivot – Low) |

| Resistance 2 = Pivot + (R1 – S1) |

| Resistance 1 = 2 * Pivot – Low |

| Pivot Point = ( High + Close + Low )/3 |

| Support 1 = 2 * Pivot – High |

| Support 2 = Pivot – (R1 – S1) |

| Support 1 = 2 * Pivot-High |

It is intriguing to me that you may ultimately arrive at seven points—the pivot point itself, three resistance levels, and three support levels—by simply knowing the high, low, and close of the previous day. The PP, R1, and S1 are the three most prevalent levels.

You do not have to be afraid if you detest algebra and the idea of using a calculator and drawing tool every day to determine and plot these levels. You do not need to compute the above formula every single day; it is merely an explanation of the theory.

Numerous MT4 indicators are capable of doing that for you, automatically figuring out the levels and displaying them on your chart in an understandable manner.

We will talk about three of the many strategies to trade using these determined pivot points:

- Trading the Bounce from Pivot

- Trading the Break of Pivot

- Trading the Bounce from Support / Resistance (R2/S2)

Discover Giant Hunter AI

First Strategy: Trading the Pivot’s Bounce (Reversal)

You can take bounce trades off the pivot point in the direction of where the market was in relation to PP at the beginning of the day if you have a solid understanding of the overall direction of the market.

The pivot point is widely regarded by traders as the primary indicator of whether the market is rising or falling. The market is considered up (bullish) if it begins the day above the pivot point and down (bearish) if it begins the day below.

| Signal Direction | Condition |

|---|---|

| Bullish | If market is above PP at beginning of day |

| Bearish | If market is below PP at beginning of day |

Furthermore, pivoting is merely reaching a support or resistance level and then reversing; the more times a currency pair touches a pivot point before reversing, the stronger the level.

When the market retests the pivot point, you would attempt to enter a bounce trade utilizing the pivot point as a basis for overall direction.

Discover Giant Hunter AI

Entry & Exit Rules:

| Entry & Exit Rules | Long | Short |

|---|---|---|

| Entry Rule | If the price starts above PP, buy at or near the PP line with a market or limit order. If PP is missed and the market advances strongly up, there is an alternate trade in the long-biased PP direction: if the market is stopped at R1 or R2 and falls back to PP, you can take a long trade from a PP bounce. | You would want the market to touch (and retouch) the line (even waiting to see how far it breaks through) and take up a trade only when the market closes x pips above the PP level, suggesting that the line held firm |

| Entry Rule (Conservative) | You would want the market to touch (and retouch) the line (even waiting to see how far it breaks through) and take up a trade only when the market closes x pips below the PP level, suggesting that the line held firm | SL a few pips above PP or above R1 for more trade leeway |

| Stop Loss Rule | SL a few pips below PP, or below S1 for more trade leeway | SL a few pips above PP, or above R1 for more trade leeway |

| Take Profit Rule | TP at S2, and if it gets to S1, move SL to breakeven | TP at R2, and if the price reaches R1, move SL to breakeven |

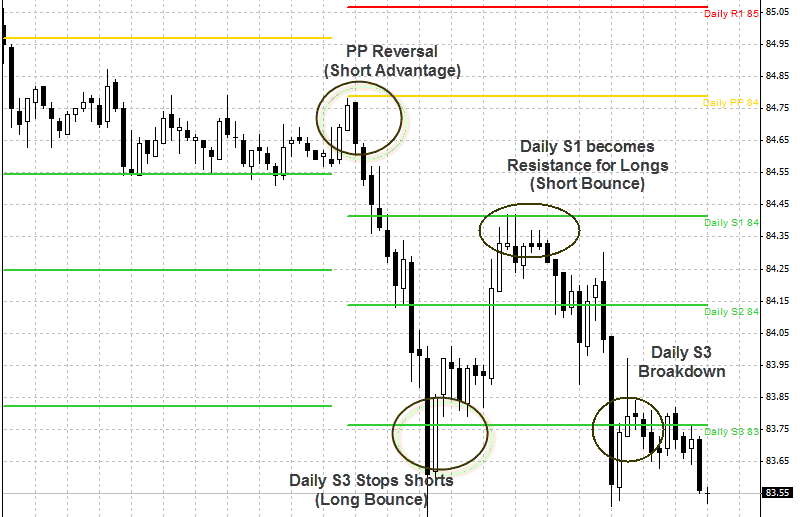

Example of USD/JPY, Daily Pivot Levels (April 11, 2011):

Here, the market begins the day just below PP, indicating a short bias, and the day’s opening bar literally kisses the PP level. It is interesting to note that the following bar, which forms a lengthy black candlestick after the PP level is struck, shows that the Bears dominated the ball (trading) for the majority of the bar without any opposition from the Bulls.

The Bears were certain they had the ball, so it was not shocking that the price dropped from there.

From the PP level, the market swiftly dropped through S1 and S2. You could only have gotten on board with this trade if you had been in the aggressive mode, which is to say, taking the short trade close to PP after observing the bearish candlestick (and not waiting for a contest at this line).

Additionally, you would have missed it if you had not been up at midnight GMT, when the pub opened. The worm goes to the first one.

Take note of how the Bulls, who were on the day’s retreat, launched a strong counterattack at S3, driving the Bears away and causing the market to rise again in order to retest the S1 level.

This is an excellent example of Strategy #3, which is covered below. In order to profit from oversold conditions, one can purchase the market at S2 or S3. If the Bull Bouncers had set a take profit two levels away at S1, they may have quickly picked up 70 pips at S3.

You would have discovered a second chance to take a short bounce at S1 if you had missed the day’s initial bounce opportunity at Pivot.

The day was short-biased since Pivot remained firm earlier in the day, then it role-reversed to become resistance because S1 was breached earlier in the day. In order to oppose the S3 Bull Bouncers, astute bearish bouncers established positions at S1, which they were able to do with ease.

Strongly bearish candlestick patterns were created by the two bars that hit S1; a lengthy upper shadow suggests that the Bulls held possession of the ball for a portion of the game but lost it toward the end, and the Bears pulled off an incredible comeback.

As demonstrated in the Pivot and S1 Bounce trades, the candlestick’s behavior following the level’s initial touch can reveal which team is in control of the ball: the candlestick’s bottom (intra-session low) indicates the Bears are in control, while the top (intra-session high) indicates the Bulls are.

The Bulls are given more credit for power the closer the close is to the high, while the Bears are given more credit for power the closer the close is to the low.

Discover Giant Hunter AI

The Dangers of Bouncing from a Pivot

The main benefit of using a bounce trade from Pivot is that the day’s trend is in your favor. Being able to play that hand to your advantage and having the upper hand is usually beneficial.

You must be alert for a possible break since the Pivot is a highly contested line and the Bull or Bear on the other side of it will frequently do everything in his power to break it. Your position and halt could be rapidly overpowered if it breaks.

Trading the Pivot Break is Strategy #2.

It is not always the case that the market begins the day above or below the PP and remains there throughout the day. In actuality, the market breaks the bounce even if you may be attempting to take advantage of it. If you used to be a bouncer, you had to be prepared to get out of your trade as soon as possible and then change strategies to capitalize on the break.

Therefore, the pivot indicates the point at which you must be prepared to change your allegiance. You can begin your allegiance based on the price’s position in relation to the opening pivot, becoming bearish if it is below and bullish if it is above.

But if the price breaks Pivot, you have to be prepared to change course. If the price breaks through Pivot, you have to be prepared to purchase the market and charge like a bull; if it breaks through Pivot, you have to be prepared to growl like a bear and sell short the market.

You should begin purchasing if the market breaks through the upward pivot, indicating that traders are optimistic about the pair. to the other hand, it indicates that traders are pessimistic about the pair and that sellers may have the upper hand for the trading session if the price breaks through the pivot to the downside.

Entry Rules:

| Entry & Exit Rules | Long | Short |

|---|---|---|

| Entry Rule | If price has traveled below PP and breaks up through PP, buy at market or stop x pips above the PP Level. Alternatively, if you have missed the break, you can buy the retest of the break at PP level. If the break happens too fast and there is no retest, you can take up a long position at R1, so long as momentum is strong and it looks as if it is going to break as well. | If price has traveled above PP and breaks down through PP, sell at market or stop entry x pips below PP level. Alternatively, if you have missed the break, you can sell the possible retest of the break at PP level. If the break happens too fast and there is no retest, you can take up a short position at S1, so long as momentum is strong and it looks as if it is going to break as well. |

| Entry Rule (Conservative) | If the price breaks the PP and H1 close above the level, then you can put in a buy limit order at the PP for getting in on the retest. | If the price breaks down through PP and the H1 closes below the level, then you can put in a sell limit at the PP level for getting in on the retest. |

| Stop Loss Rule | SL fixed pips below PP, or a few pips below the S1 level for more trade leeway | SL fixed pips above PP or a few pips above the R1 level for more trade leeway |

| Take Profit Rule | TP at R2. If price reaches R1, set your SL to PP level to minimize risk. | TP at S2. If price reaches S1, set your SL to PP level to minimize risk. |

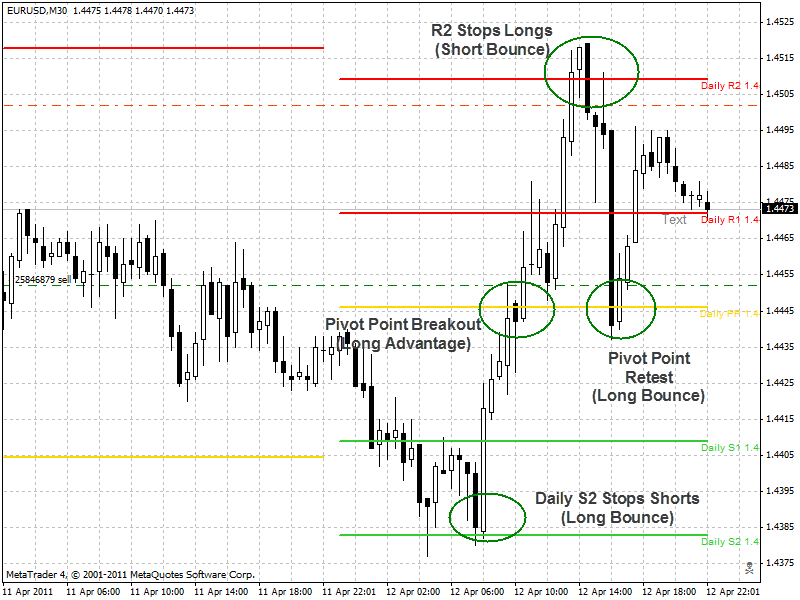

Example of EURUSD M30 using Daily Pivots:

The EURUSD began the day below the PP level in the above chart, indicating a short bias for the day. Without waiting for a PP test, traders began shorting the currency pair and continued to do so until it was stopped at the S2.

After S2 was retested and held firm, the Bullish Bouncers that were waiting there pushed the market higher to the 1.4045 pivot, where a brief two-hour struggle was fought. The Bulls would have had some hope when the first H2 bar to reach Pivot burst through it by 10 pips.

At that point in time, it would have appeared as though the Bearish Pivot Bouncers had prevailed and that the EURUSD had been successfully denied at pivot, but the subsequent bar slid backwards by 25 pips.

However, if you closely examine the candlestick, you will notice an intriguing twist at the end of that bar: the lengthy lower shadow suggests that the Bears held possession of the ball for a portion of the game but lost it near the end when the Bulls mounted a strong comeback.

The Bulls were inspired to push the market through to break the PP on the following bar by that remarkable comeback, and when PP was successfully breached, the remainder of the day was in their favor. The Bulls forced the market up to R2, where it was finally defeated after another 4-hour battle at the R1 level.

Take note of the Bears’ impressive comeback at the R2, where they forcefully pushed the market lower to retest the PP level. The Bears were on the day’s retreat.

The market can be sold at R2 or R3 to profit from overbought situations, or it can be bought at S2 or S3 to profit from oversold conditions. This is a nice example of Strategy #3, which is covered below. A quick 60 pip gain would have been possible for the short bouncers at R2.

Discover Giant Hunter AI