Introduction to Forex Strategies and Analysis

Forex trading can seem complex at first, but with the right forex strategies and analysis tools, you can make more informed decisions and approach the market with confidence. In this guide, we’ll introduce you to the essentials of Forex strategies and analysis, helping you understand why they’re key to successful trading.

Why Are Strategies Important?

Having a strategy in Forex trading is like having a roadmap. A trading strategy is a set of rules that helps you determine when to buy, sell, or hold. By using a strategy, you can make decisions based on a clear plan rather than on emotions or spur-of-the-moment judgments. This approach not only helps you stay consistent but also allows you to review your trades more effectively to see what’s working and what isn’t.

What is Forex Market Analysis?

Forex analysis is the process of studying the market to understand where currency prices might move next. There are different ways to analyze the Forex market, each offering unique insights. Here are the three main types of analysis:

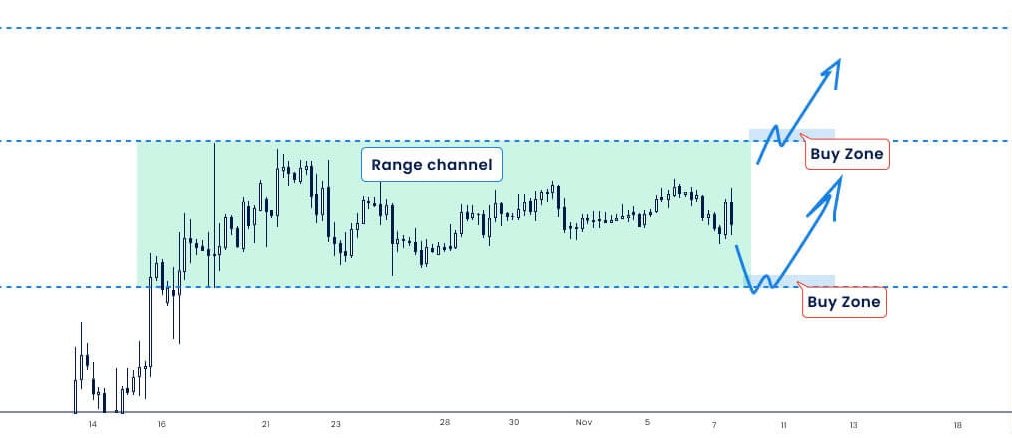

- Technical Analysis: This method involves studying price charts and patterns. Traders look at past price movements to identify trends or key levels that might indicate where prices are likely to go in the future.

- Fundamental Analysis: In fundamental analysis, you look at economic factors, such as GDP, interest rates, inflation, and news events that can impact a currency’s value. This approach is useful for understanding the long-term direction of a currency.

- Sentiment Analysis: This type of analysis focuses on the overall mood or “sentiment” of traders in the market. Understanding whether traders are feeling optimistic or cautious can give insights into likely market trends.

How Strategies and Analysis Work Together

Effective Forex trading often combines strategy with analysis. For example, a trader might use technical analysis to identify an entry point for a trend-following strategy. Meanwhile, they could use fundamental analysis to understand the broader economic conditions affecting the currency pair. By combining approaches, traders can make better decisions that account for both short-term and long-term factors.

Setting Realistic Goals

It’s essential to set realistic goals and manage expectations. No strategy or analysis technique can guarantee success, but a structured approach significantly improves your chances. For beginners, we recommend starting with simpler strategies, practicing on a demo account, and gradually expanding your knowledge.

Continuous Learning and Adaptation

The Forex market is always evolving, driven by global economic events and trends. Continuous learning is crucial, as even experienced traders need to adapt to market changes. Keep studying, testing new strategies, and refining your analysis skills to stay ahead in this dynamic market.

Ready to dive deeper? Now that you have a solid understanding of why strategies and analysis are essential, explore our other guides to learn about specific Forex strategies and analysis techniques in detail. Start building a structured, confident approach to Forex trading today!