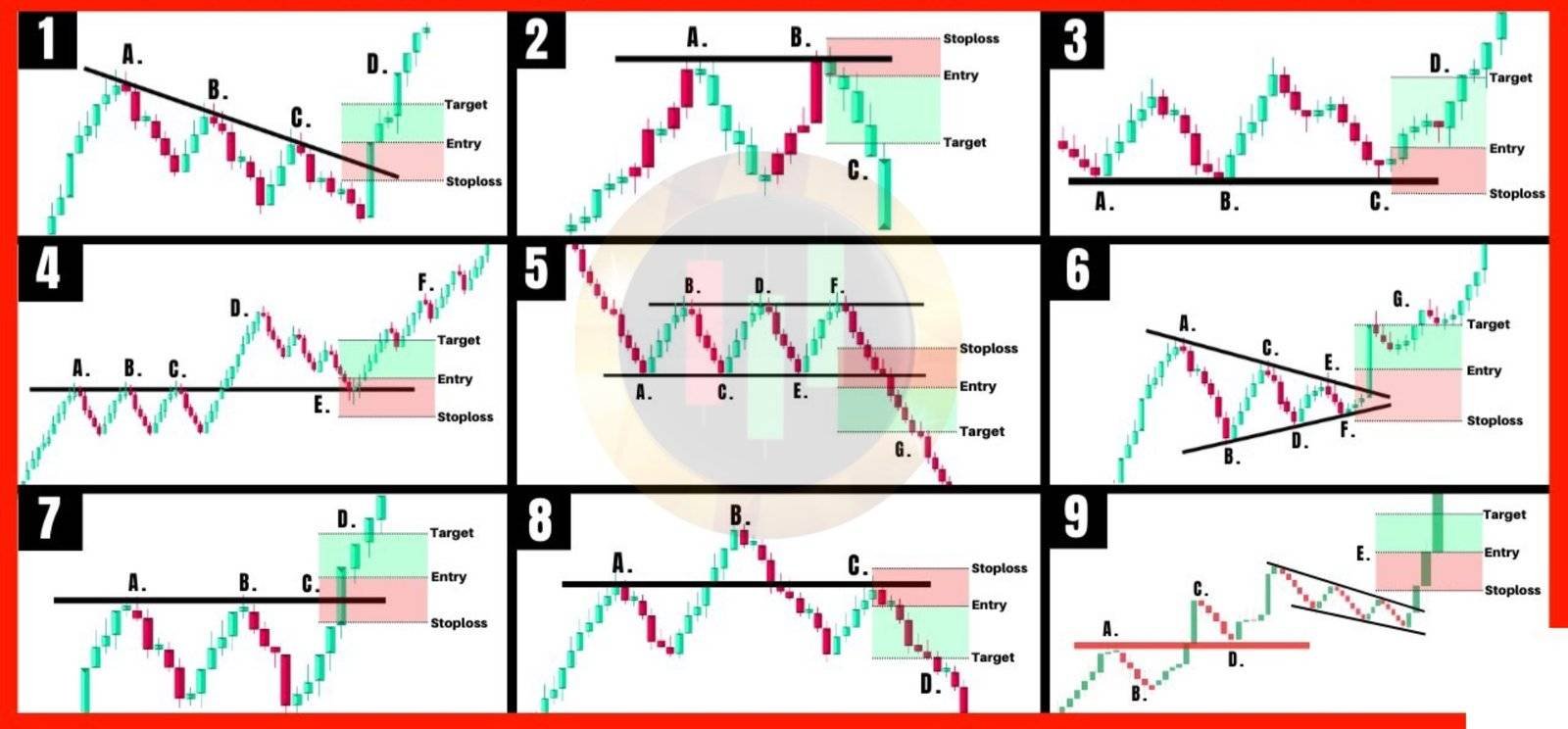

Trading strategies and tactics

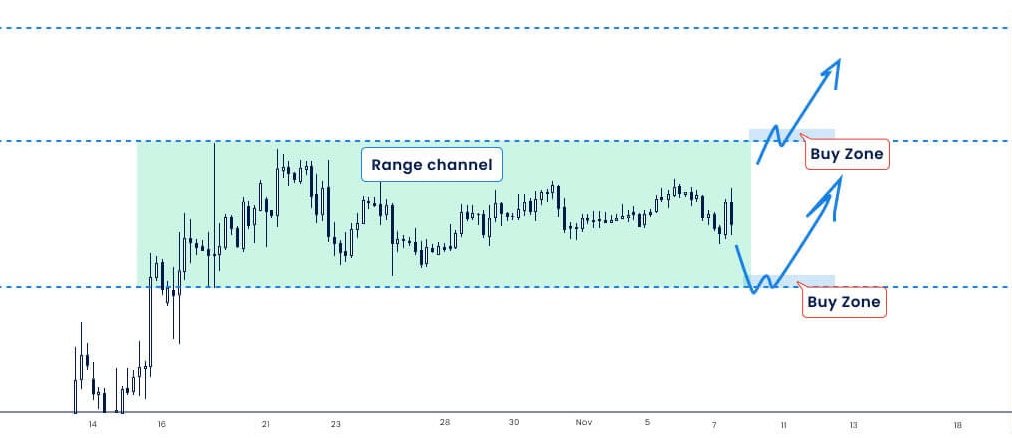

Trading strategies and tactics is now our main topic because, in recent chapters, you’ve covered three crucial elements of price action trading: First, market trends: you now know how to spot trends by analyzing multiple…