In Forex trading, understanding basic units like pips, spreads, and lots is essential for calculating profits and losses, measuring price movements, and managing trades effectively.

Here’s a breakdown of what these terms mean and how they function in the market.

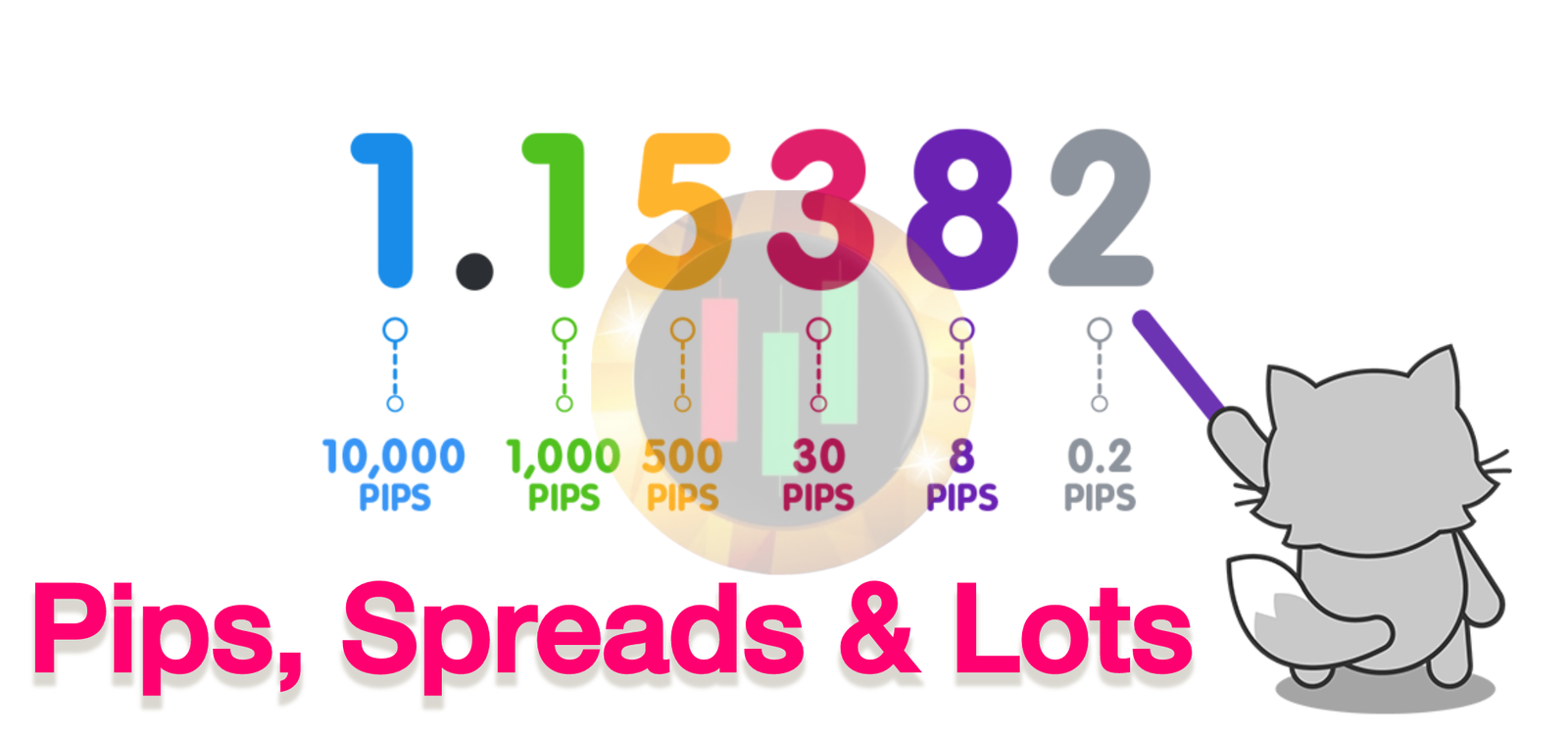

1. Pips (Percentage in Points)

A pip is the smallest unit of price movement in a currency pair. Most currency pairs are quoted to four decimal places, and a pip represents a 0.0001 change in price.

For pairs involving the Japanese yen, a pip is measured at two decimal places (0.01).

Example:

- If EUR/USD moves from 1.1200 to 1.1205, that is a 5-pip change.

- If USD/JPY moves from 110.25 to 110.30, that is a 5-pip movement.

Why Pips Matter:

Pips are essential for measuring the smallest price changes in currency pairs and calculating profits or losses.

Since Forex trading often involves leverage, even small pip movements can result in significant gains or losses.

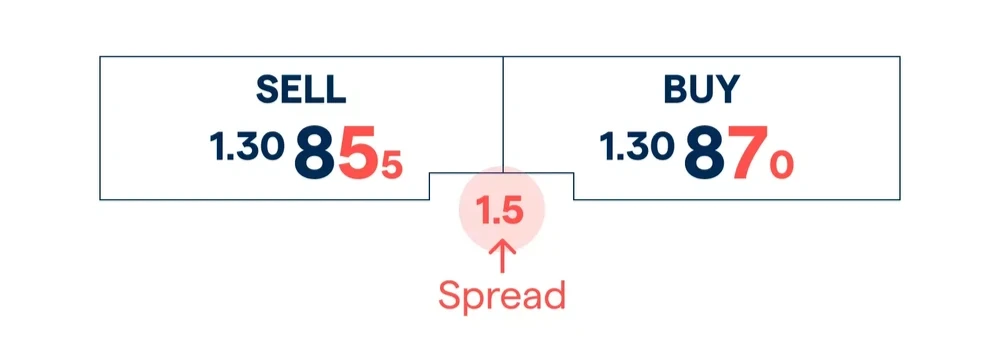

2. Spreads

The spread is the difference between the bid (selling) price and the ask (buying) price of a currency pair.

The bid price is the highest price a buyer is willing to pay, while the ask price is the lowest price a seller is willing to accept. Spreads are usually measured in pips and represent the broker’s profit on each trade.

Types of Spreads:

- Fixed Spreads: Some brokers offer fixed spreads, which remain constant regardless of market conditions. These are common in standard or beginner trading accounts and help traders anticipate costs.

- Variable Spreads: These spreads fluctuate depending on market volatility. Variable spreads can be narrower in calm markets and widen during high volatility, such as during major economic releases.

Example of Spread Calculation:

If the bid price for EUR/USD is 1.1200 and the ask price is 1.1203, the spread is 3 pips.

Importance of Spread:

The spread affects the cost of opening and closing a position. When you enter a trade, the market must move in your favor by at least the spread amount before you can break even.

For this reason, lower spreads are preferred, especially by day traders who rely on frequent trades.

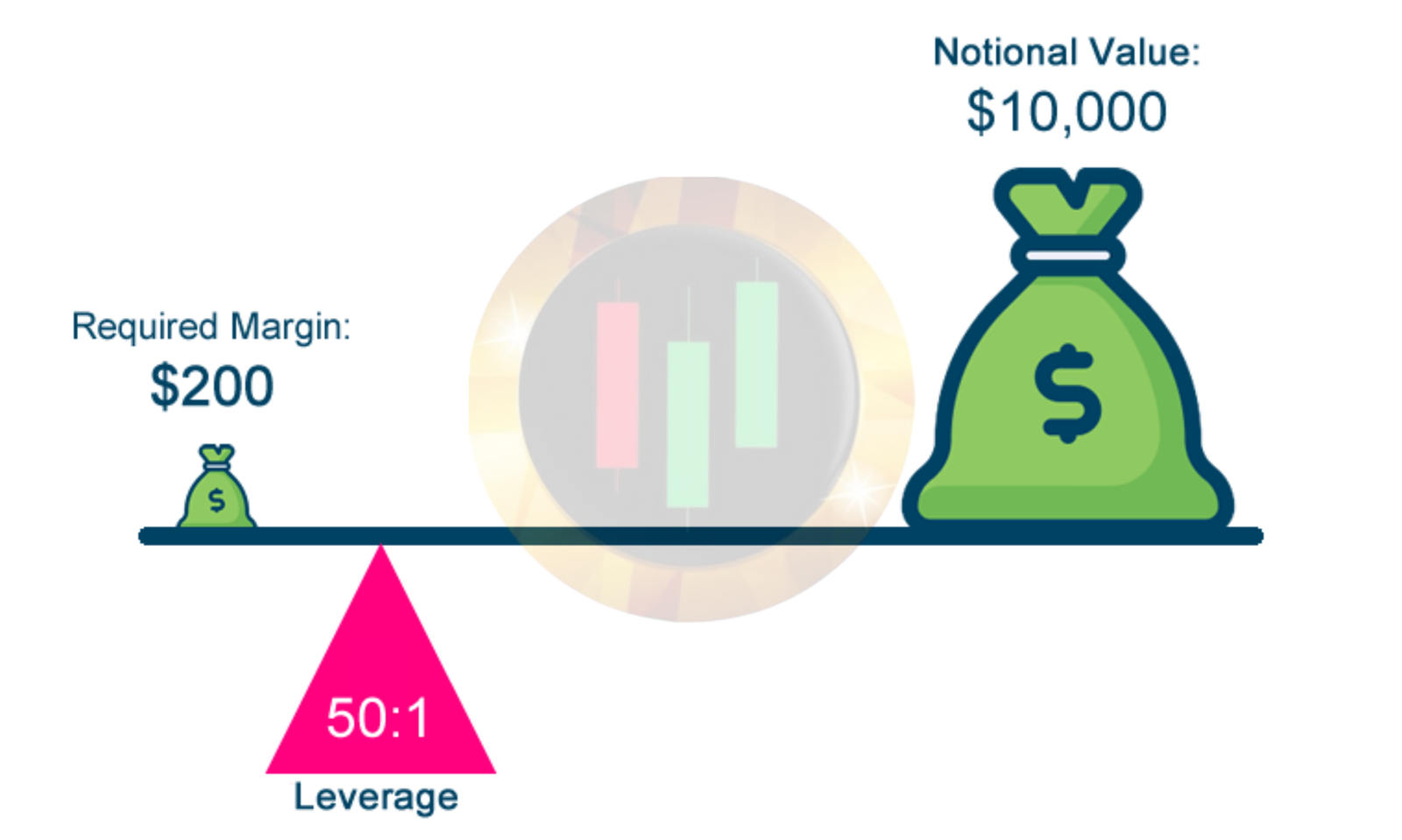

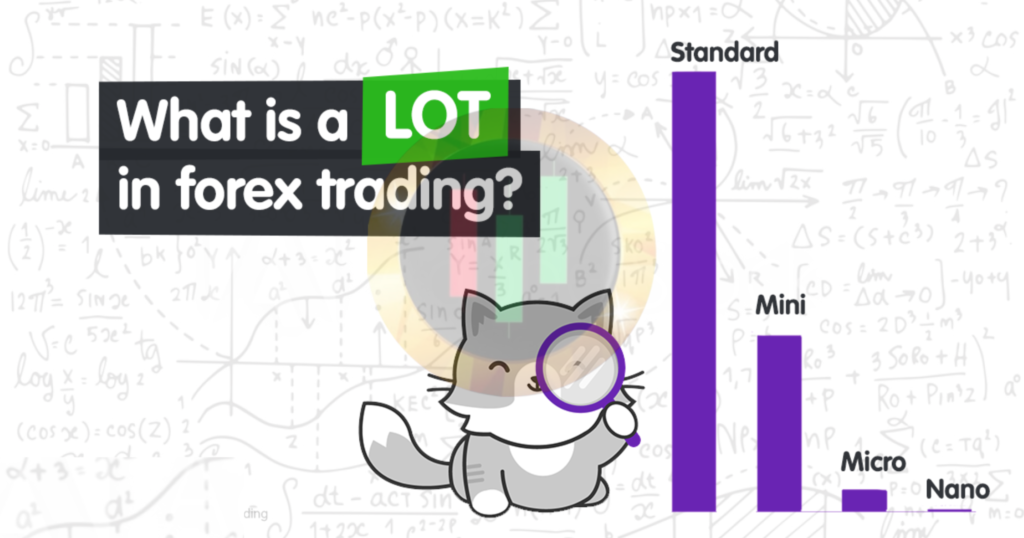

3. Lots

A lot is the standard unit size for Forex trades. Currencies are typically traded in fixed contract sizes, known as lots. There are three common lot sizes:

- Standard Lot: 100,000 units of the base currency. Each pip movement in a standard lot is worth approximately $10.

- Mini Lot: 10,000 units of the base currency. Each pip movement in a mini lot is worth approximately $1.

- Micro Lot: 1,000 units of the base currency. Each pip movement in a micro lot is worth approximately $0.10.

Example of Lot Sizes and Pip Value:

If you trade one standard lot of EUR/USD and the pair moves by 1 pip, you would gain or lose $10. With a mini lot, a 1-pip movement would result in a $1 change, and with a micro lot, the impact of 1 pip would be $0.10.

Choosing the Right Lot Size:

The choice of lot size depends on your risk tolerance, account size, and trading strategy. Smaller lot sizes allow for greater flexibility and risk management, especially for beginner traders.

How Pips, Spreads, and Lots Work Together

These elements come together to calculate profit and loss in Forex trading. The pip value, spread, and lot size determine the cost of entering and exiting trades and directly impact potential returns.

For instance, a tighter spread reduces the entry cost, and selecting the appropriate lot size allows for better control of the risk-to-reward ratio.

Summary

- Pips measure price movement in a currency pair and determine profit or loss.

- Spreads represent the cost of trading and vary between brokers and market conditions.

- Lots define the trade size and influence the impact of each pip movement on your trade.

By understanding pips, spreads, and lots, traders can calculate the costs, risks, and potential profits more accurately and manage their Forex positions more effectively.