Risks in forex trading refer to the potential for financial loss due to factors such as market volatility, leverage, liquidity issues, interest rate changes, counterparty defaults, and emotional decision-making.

Have you ever lost money despite your best efforts in trading? We know how hard it can be. About 70% of traders face this challenge. Often, it happens because they don’t know how to manage their risks effectively. This course will help you join the remaining 30% of successful traders.

The course consists of 5 lessons, each taking 10 minutes to complete. You can take the lessons consecutively or in any order you want.

By the end of this course, you’ll know essential risk management concepts and techniques.

Each lesson includes real-life scenarios, proven strategies, and a short quiz at the end, making it useful for both beginners and experienced traders.

So, let’s get started!

Discover Giant Hunter AI

Risks in trading

To understand risk management better, let’s think of trading as sailing in the sea.

1. Forex Ocean

Think of the Forex market as an unpredictable ocean. Like waves are influenced by wind and weather, currency prices are affected by economic data, political events, and unexpected news.

2. Storm risks

Trading risks are like storms that can lead a ship astray or sink it. Losing capital and being unable to continue trading is one of the most detrimental outcomes of such a risk.

3. Risks are navigated

However, just like sailors use paddles and sails to navigate through storms safely, traders can use tools to minimize their risks.

This example shows that despite inevitable losses, your overall income can grow steadily, ensuring your trading journey stays on track.

Managing your trading results

Trading is like managing a business.

Since he started trading, he has seen many similarities between managing his stand and being a trader.

Point 1. Expenses and losses

Expenses are a big part of any business. Rent, ingredients, and labor are all basic expenses associated with Mr. Riskman’s lemonade stand. They are unavoidable.

Losses from some trades are the equivalent of basic expenses in trading.

There’s no trading strategy that’s 100% successful, and losses are inevitable. Trading losses are normal expenses, just like any other business costs.

Point 2. Statistics

Just like in business, not every trading day will be a success. Despite that, your monthly revenue can still be profitable.

Analyze your trading over a longer period rather than

one day to see your overall profit.

Point 3. Discipline

As Mr. Riskman tracked his sales and expenses to discover new methods to increase profits, he saw the benefits of this practice.

Similarly, traders must diligently analyze their decisions and results to improve their strategies.

Tracking and analyzing your actions is crucial for your trading success.

Trading journal

Traders keep trading journals to document their trades, strategies, and results.

Keeping a trading journal is crucial for risk management. It allows you to analyze past trades, identify patterns and mistakes, and make informed adjustments to minimize losses and maximize gains.

How to keep a trading journal

To begin, create a spreadsheet on paper or digitally. Then, you need to write down the details of all trades you’ve made during a session. Different types of data are written down at different points in time.

To better understand trading journal entries, let’s break them down into three steps.

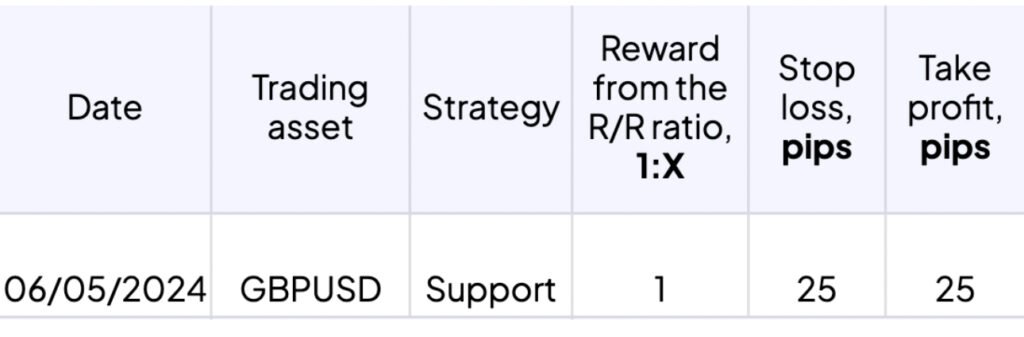

Step 1

After opening a position, write down:

- date

- trading asset

- strategy

- risk/reward ratio

- stop loss

- take profit.

Step 2

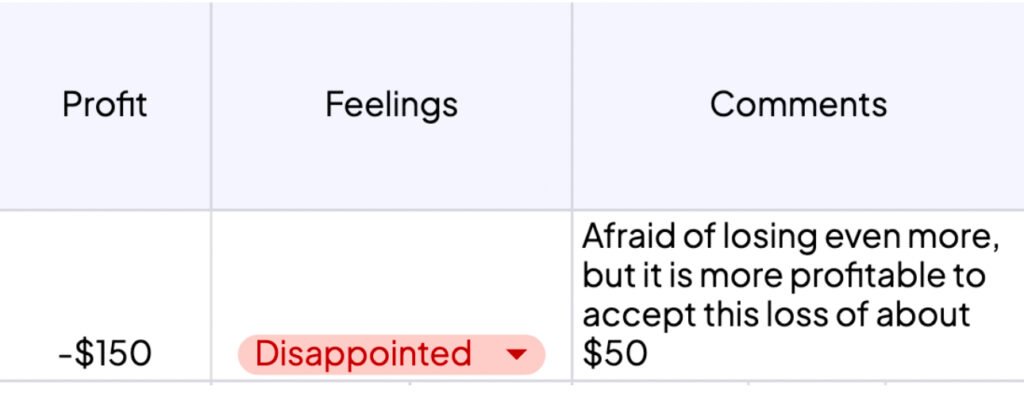

Once you’ve closed a position, add to your journal:

- total profit

- your feelings

- any comments

- a price chart screenshot.

Step 3

Every week, calculate and write down the following statistics:

- net profit

- win rate (percentage of profitable trades)

- average risk/reward ratio.

Traders usually group statistics by time, strategy, and assets.

Summary

Losses and risks are inevitable in trading, but you can manage them to protect your profit from critical fall.

2. To figure out where to improve your trading, you first need to know your current statistics.

Keep a trading journal so you can analyze your trading.

activity regarding risks and other factors.

Great, now you know what trading risk is and how to keep track of your trades.

In the next lesson, you will learn how to deal with emotions that affect your ability to make informed decisions.