Trend lines are diagonal lines drawn on price charts to indicate the general direction of the market—either up, down, or sideways.

They are fundamental tools in technical analysis, helping traders identify potential support and resistance levels and make informed trading decisions.

Their importance in Forex:

- Identifying Trends: They visually indicate the market’s direction, helping traders determine whether it’s a good time to buy or sell.

- Spotting Breakouts: When price breaks through a resistance or support level, it may signal a potential trend reversal or continuation, depending on the market conditions.

- Setting Entry and Exit Points: They can act as dynamic support and resistance levels where traders may place orders, as prices often react around these lines.

- Limitations:

- They are subjective, as traders may draw them differently.

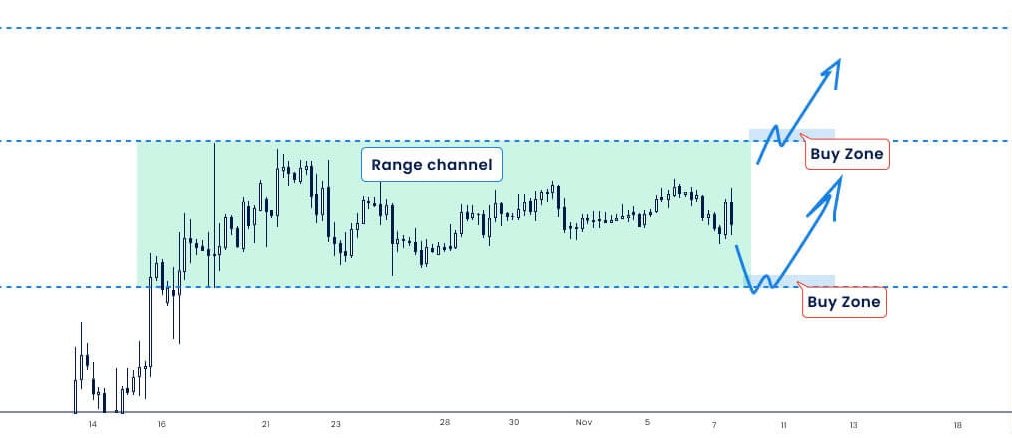

- They can become less reliable in highly volatile or range-bound markets.

Discover Giant Hunter AI

Tips for Using Trend Lines Effectively:

- Confirm trend lines with other indicators, such as moving averages or the Relative Strength Index (RSI).

- Avoid forcing a trend line to fit—only draw lines that connect significant highs or lows with a clear trend pattern.

They are versatile and, when used with other technical analysis tools, can greatly enhance the effectiveness of a trading strategy.

How to draw trend lines?

To draw quality support/resistance levels, identify at least two clear swing points and connect them. Avoid forcing trend lines or using smaller time frames; instead, use 4-hour or daily charts for clearer levels. This approach helps identify the start of impulsive moves in trending markets. In the next chapter, we’ll dive into trading trend lines alongside price action setups.

The market often respects them, reversing and continuing in the trend’s direction as prices approach it.

This behavior allows trend lines to help anticipate the next impulsive move aligned with the market’s trend. See an example of an uptrend market.

In conclusion, they are essential tools in Forex trading, offering a visual representation of market direction. They help traders identify trends, spot potential breakout points, and establish key entry and exit levels.

While they provide valuable insights, they should be used in conjunction with other technical indicators for confirmation, as they can be subjective and less reliable in volatile or range-bound markets.

By mastering their usage, traders can improve their market analysis and enhance their decision-making, ultimately leading to more successful trades.