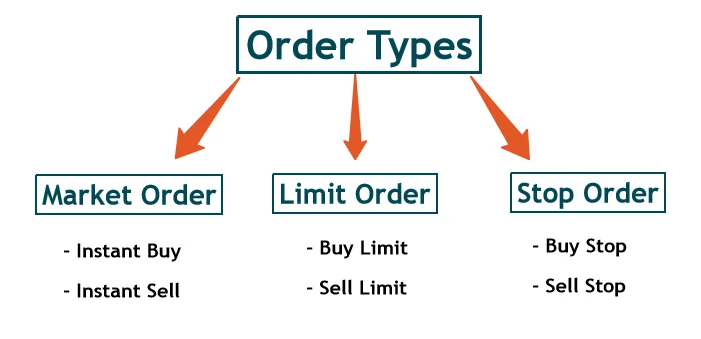

In Forex trading, an “order” is an instruction to enter or exit a trade. Different types of orders allow traders to execute trades based on specific conditions, helping them control their entry and exit points, manage risk, and automate parts of their strategy. Here’s an overview of the most common types of orders used in Forex trading:

1. Market Order

A market order is an instruction to buy or sell a currency pair at the current market price. It’s executed immediately, and the trader enters the market at the best available price.

- When to Use: Market orders are typically used when a trader wants to enter a position quickly, without waiting for specific price conditions.

Example:

If EUR/USD is currently trading at 1.1000 and a trader places a market buy order, the trade will execute as close as possible to 1.1000, though the actual fill price may vary slightly depending on liquidity.

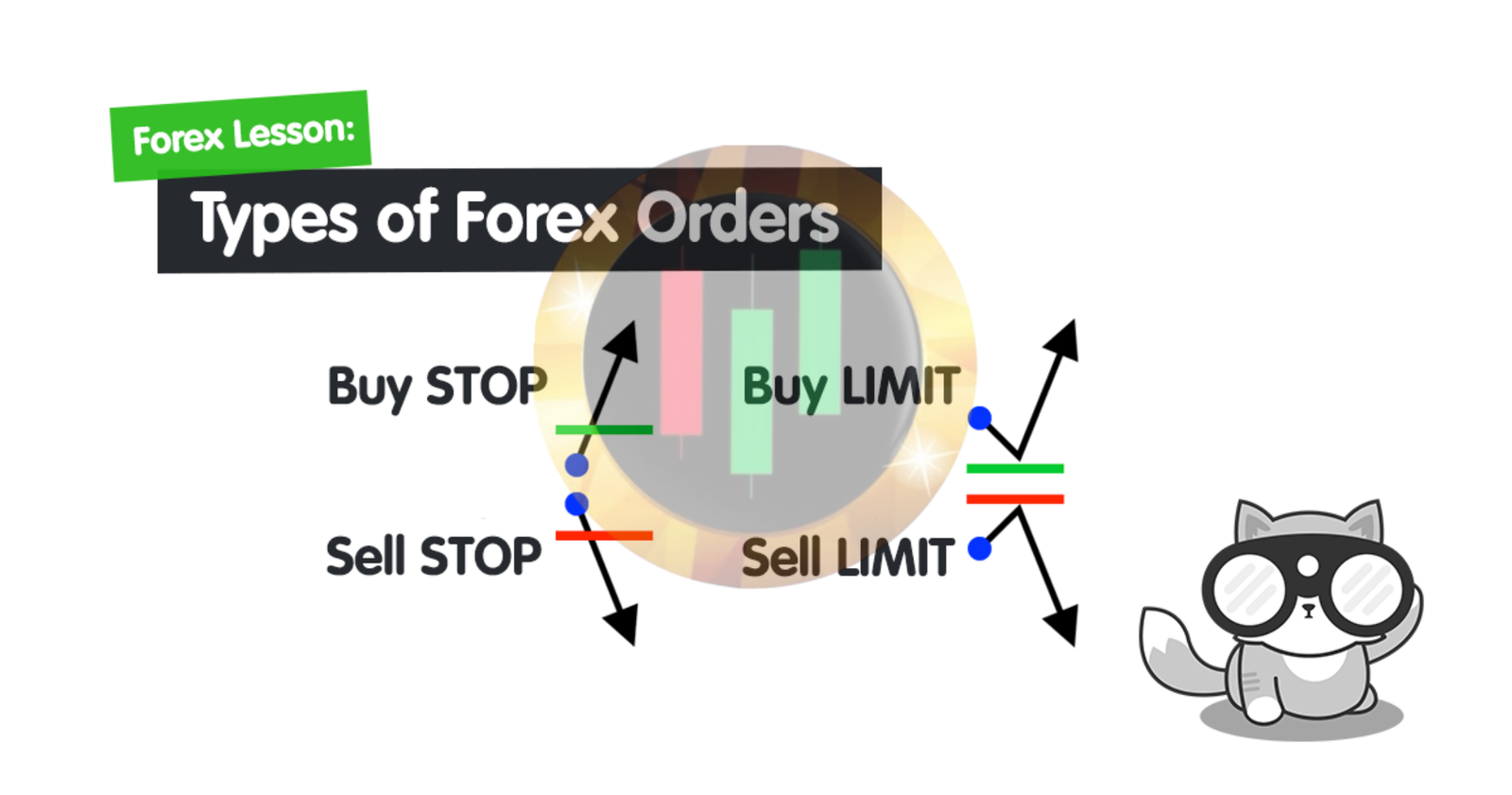

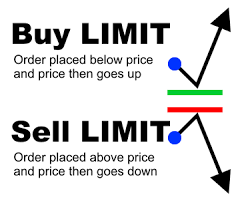

2. Limit Order

A limit order is an instruction to buy or sell a currency pair at a specific price or better. Buy limit orders are placed below the current market price, while sell limit orders are placed above it.

A limit order only executes if the market reaches the specified price level.

- When to Use: Limit orders are used when a trader expects a certain level of support or resistance and wants to enter or exit the market at a more favorable price.

Example:

If EUR/USD is currently trading at 1.1000 and a trader places a buy limit order at 1.0950, the order will only execute if the price drops to 1.0950 or lower.

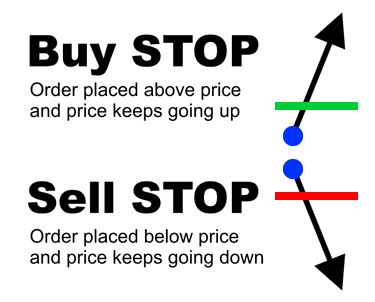

3. Stop Order

A stop order, also known as a “stop-loss order,” is an order to buy or sell a currency pair once it reaches a specified price. A buy stop is placed above the current market price, while a sell stop is placed below.

Unlike limit orders, stop orders execute at the next available price once triggered, which may differ slightly from the specified level.

- When to Use: Stop orders are often used to limit losses or protect profits. They can also be used to enter the market when a trader expects the price to continue moving in a particular direction.

Example:

If a trader holds a long position on EUR/USD at 1.1000, they might place a stop-loss order at 1.0950.

If the price falls to 1.0950, the stop order will trigger and close the position, limiting further losses.

4. Stop-Limit Order

A stop-limit order combines elements of both stop and limit orders.

When a specified stop price is reached, the stop-limit order becomes a limit order at a predetermined price. Unlike a regular stop order, a stop-limit order will only execute at the limit price or better, offering more control over the price at which the trade is executed.

- When to Use: Stop-limit orders are used when traders want more control over the price at which an order will execute, helping avoid slippage. However, there’s a risk that the order may not fill if the market moves too quickly past the limit price.

Example:

If EUR/USD is trading at 1.1000, a trader could set a stop price of 1.0950 and a limit price of 1.0945. If the price drops to 1.0950, the order turns into a limit order at 1.0945. The trade will only execute at 1.0945 or better.

5. Take-Profit Order

A take-profit order automatically closes a trade once it reaches a specified profit target. This order ensures that profits are locked in before the market can reverse.

- When to Use: Take-profit orders are typically used to close positions once they reach a pre-determined level of profit, especially if a trader expects a reversal after the price target.

Example:

If a trader enters a long position on EUR/USD at 1.1000 with a take-profit order at 1.1100, the trade will automatically close once the price reaches 1.1100, securing the profit.

6. Trailing Stop Order

A trailing stop order is a dynamic order that moves with the market price, “trailing” by a set number of pips. If the market moves in the trader’s favor, the trailing stop adjusts, locking in profits.

However, if the market reverses by the specified distance, the trailing stop activates, and the position closes.

- When to Use: Trailing stops are useful for managing risk while allowing for potential profit as the trade moves in the trader’s favor.

Example:

A trader buys EUR/USD at 1.1000 and sets a trailing stop of 20 pips. If the price rises to 1.1020, the trailing stop adjusts to 1.1000. But when the price then rises to 1.1050, the stop moves up to 1.1030.

If the price falls by 20 pips from its peak, reaching 1.1030, the position will close.

Summary

Each type of order serves a different purpose, from managing entry and exit points to controlling risks and automating trades. Here’s a quick overview:

- Market Orders: Immediate execution at the current price.

- Limit Orders: Execute at a specified price or better.

- Stop Orders: Trigger a market order when a certain price is reached.

- Stop-Limit Orders: Trigger a limit order at a specific price once the stop price is reached.

- Take-Profit Orders: Close a trade at a profit target.

- Trailing Stops: Adjust dynamically with price to secure gains while limiting losses.

Choosing the right order type helps traders execute their strategies more effectively, providing more control over their trading decisions and minimizing risks in the fast-paced Forex market.